A common expression in the 60s and 70s, the title is an idiom used to convey, “Acting in a way that is likely to cause trouble.”

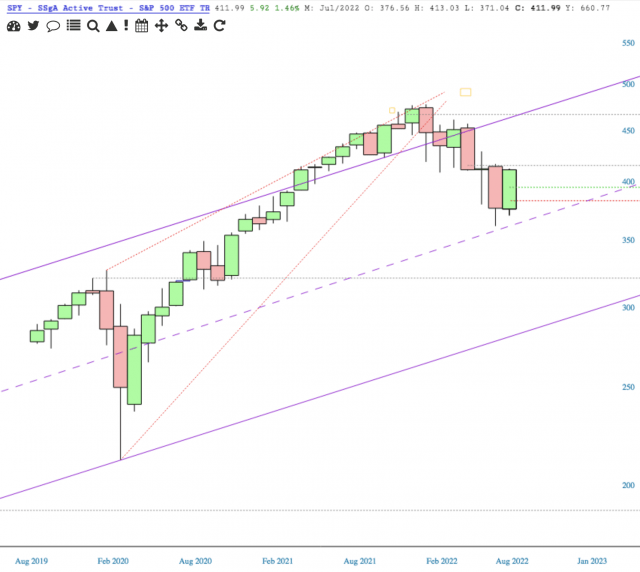

If there is one thing we should remember about a bear market, it is that during one, bull “relief” rallies can be vicious. Vicious would translate into making us think the market has turned around, made a bottom, and the bear market is done.

The quagmire we find ourselves in: Will economic contraction continue or is there a light at the end of the tunnel for monetary policy? Recession or no recession? Has inflation peaked? And the most dubious boggle of all – wrangling the markets since 2008 – is speculation and worry over what the almighty FED may do.

Inglorious, it is.

As our renowned Mr. Wizard has commented, “I don’t think there’s any really good way to avoid needing to trade during major bears, because the small chance of major downside risk dominates the future returns.”

Further to Mr. Wizard’s point, Mike Shedlock of MishTalk warns, “Even if the recession isn’t long, this is a very nasty brew. The economy rates to be weak, perhaps flirting with recession for a long time. So expect a disaster in the stock market. We are not close to the bottom.”

So here we are, with the first trading day of August tomorrow [Monday], and the monthly chart for July closed viciously bullish. Do note however, that March closed with a bullish engulfing candle, and that did not keep the indices from a big drop in April.

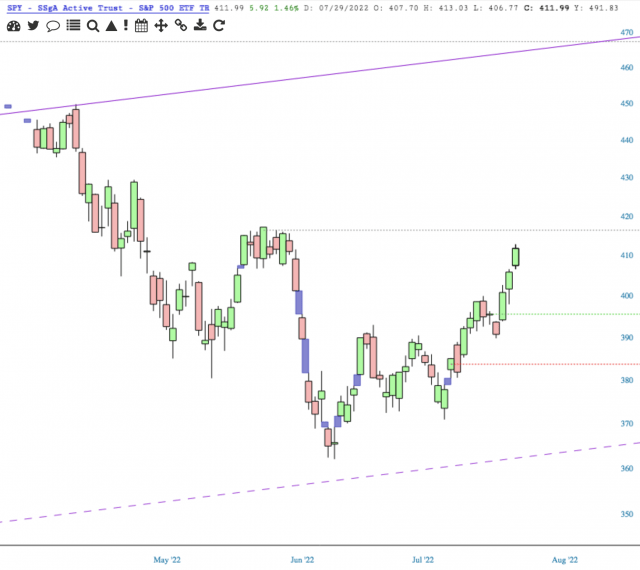

On the SPY daily chart, the gray horizontal resistance is at the 200ema.

Holding to the sentiment that the markets are cruisin for a bruisin, here are some issues of note.

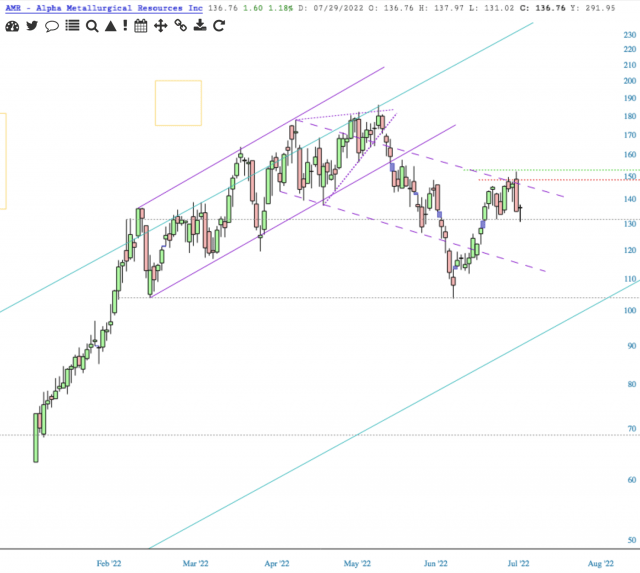

It looks doubtful that AMR will muster the gumption to regain bullish momentum. We shall see what earnings on August 8 bring about.

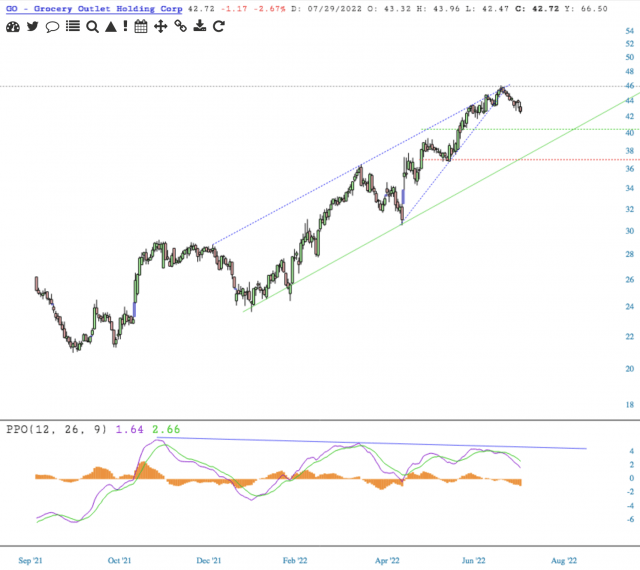

Grocery retailer GO has fallen from a bearish rising wedge along with showing negative divergence on the PPO indicator. Earnings are August 9.

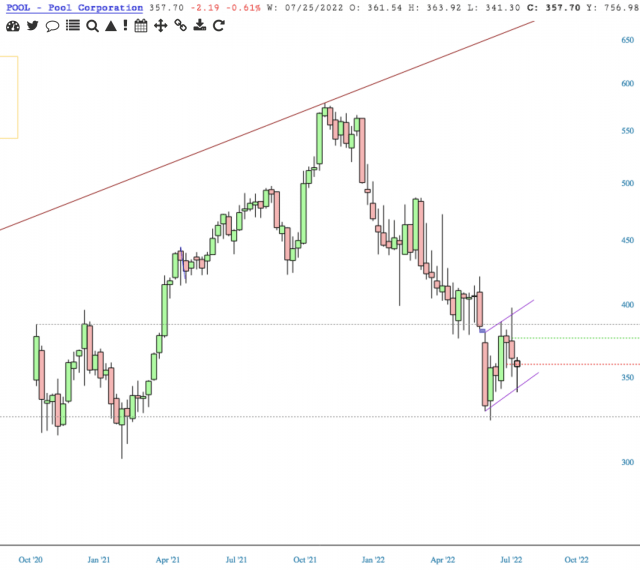

POOL, the world’s largest wholesale distributor of swimming pool and related backyard products had earnings on July 21 and has not fared well since. The weekly chart closed just below the Ichimoku Cloud.

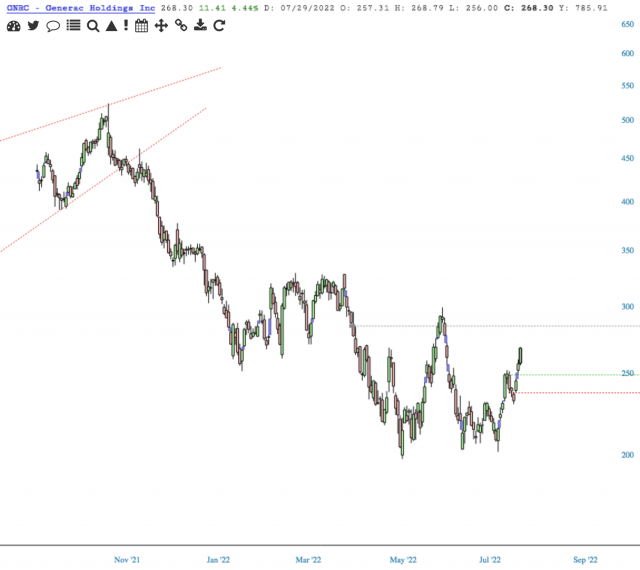

Ever since GNRC fell from a bearish rising wedge in November 2021, it has not made higher highs. The daily, weekly, monthly and even quarterly charts are bullish, although price is approaching resistance of the 200ema at 285. Earnings are August 3.

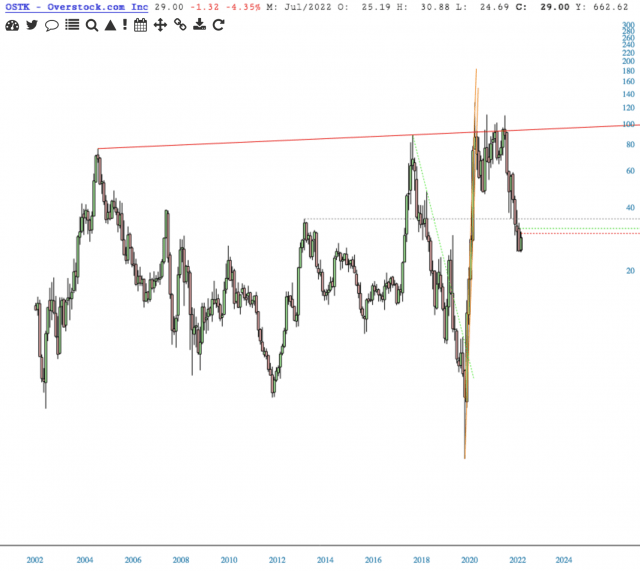

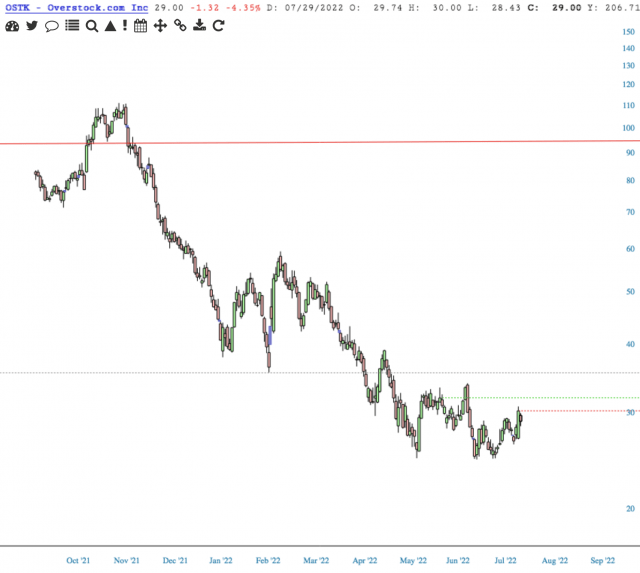

In competition with all other big retailers, OSTK is one ugly chart.

The daily chart of OSTK doesn’t offer a lot of hope for future upside. Earnings were July 28.

Time will tell how these issues fare, but it looks as though some bruising will continue.