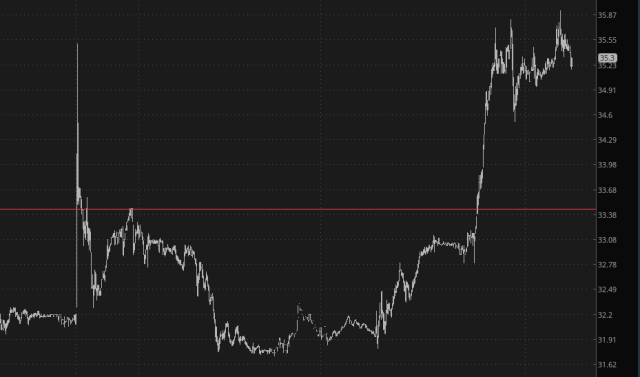

Well, I thought the huge spike we witnessed for a few minutes on Sunday was all that it would take to expurgate the short-covering and FOMO-ing of the recently-mega-juiced Chinese stock market, but nope, we beat even the Sunday Spike this morning. The fact that Chinese stock market is closed isn’t stopping the mania.

I’d like to point out, if I may, that we had the same kind of government-spurned fireworks show happening precisely five months ago, and the entire effort completely unraveled. Just sayin’.

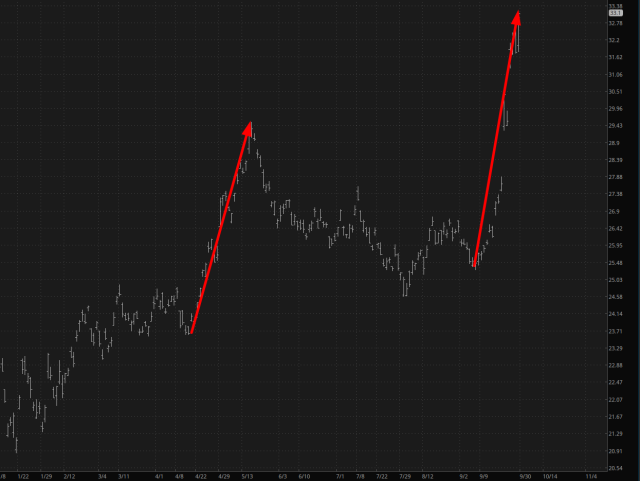

All the same, I’m glad I dumped my PDD puts yesterday. Sadly, my JD puts are probably going to take a bath, although YUMC is tepid enough that I may even just add more puts to that position. I’ve tinted in green on the daily charts below an approximation of what’s happening pre-market.

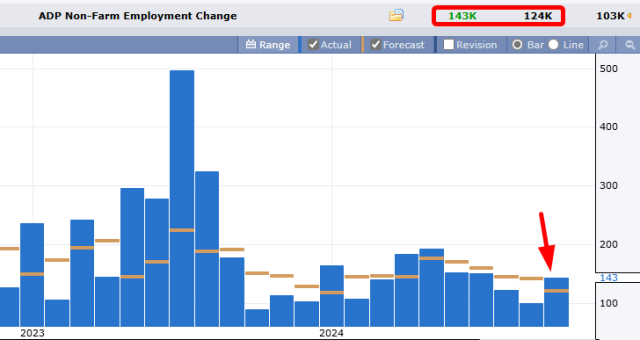

Closer to job, job gains were stronger than expected, which splashes a bit of cool water on Fed interest-rate-cutting zealots. As of this writing, small caps are down about 2/3rds of a percent whereas ES and NQ are down, in highly technical terms, just a skosh.