The USD cannot catch a bid. No one seems to want it these days. Below is a three year weekly chart of the DXY which has traded nicely within a narrowing range. When QE2 was announced at Jackson Hole in August the USD continued its slide and then caught a bounce. The bounce appears to be purely technical.

That technical bounce though for the first time did pierce the trend line. Granted it recovered the next day and moved back up but it looks to be a true "dead cat" bounce. So here it is now ready to test the trend line again. Literally by the time I finish this post it may break through. Seems the only thing that can save the USD right now is either an end to QE, highly unlikely or some geopolitical risk that lasts beyond a day.

If the trend line breaks then there is some near term support for perhaps another bounce at 76, then 74 then 70. A true break though of this trend would be very bearish though. It's rather concerning. I saw a report today that extrapolated the prices paid component to the ISM manufacturing data to CPI 12 months out. It forecasts 6.2% CPI. How do people on fixed incomes, people struggling to make ends meet right now budget for such an increase? How do companies manage margins for discretionary products where passing price along is almost impossible? In the words of Larry Kudlow, inflation is a tax on the consumer.

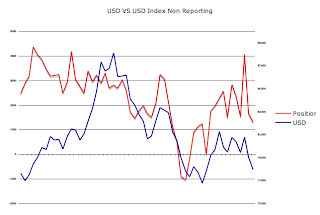

To get a sense of how traders are positioned the weekly CFTC COT report can be very useful. Below are two charts comparing commercial net positions and non reporting net positions versus the USD. The correlations are not very tight but I do think you can look at relative positions to get a sense of directional change.

Commercial net positions per the chart below are at prior maximum net long positions where they have reversed in the past. Over the past seven months this chart has had an inverse correlation so a decrease in net long positions implies USD strength. Again, it's not very clear how to interpret this data other than to look at the relative net positions the past 14 months as charted below.

Non reporting net positions have moved very net short in a very brief period of time. Knowing how the market likes to fade this group, it's quite possible a USD reversal occurs purely to squeeze these positions. This group had been going more net long while the USD traded within a tight range and has been slow in getting net short as the USD has declined.

At some point, USD weakness will not be good for risk assets. It already is not good for the American consumer. Makes manufacturing reports look pretty in the short term until margin compression further hits employment causing even weaker demand.

Submitted by Runedge. If you would like to follow my blog, please visit - Ultra Trading