I find it amusing how the mainstream media is blaming (or, as I would prefer to put it, crediting) Kim Jong Un’s nuclear test for the drop in equities on Friday. First of all, news of the nuclear test came out nearly an entire day before equities started weakening! In this day and age, reactions are instantaneous on the order of milliseconds. Indeed, I was reading about the nuclear test and the ES was green on Thursday night! So, as usual, the mainstream media is full of it.

And anyway, even though the leader of North Korea is quite evil, in some ways he seems a very sensible chap.

There’s another evil person who terrifies me far more than the chubby, hairless fellow above, and that’s the chubby, hairy fellow below. Yech. This thing actually reproduced at one point.

Gaze into the heart of darkness.

But the spotlight won’t be on Yellen until the 21st, so until then, we have more-or-less free markets to work with. I must say, I was getting despondent at the up-a-little-each-day nature of stocks that had been persisting for something like ten weeks. I was revolting. There’s nothing like a nearly 400 point drop in the Dow to lift my spirits. As I say on such days: if only every day could be like that. If negative numbers are possible with interest rates, why not with stocks?

The reason for my post’s title – “longer” – is that over the past several weeks, I’ve received word from a number of trusted Slopers (who are far from permabears – – pretty much the exact opposite) telling me that the prospect of a really big drop in September and/or October is substantial. I won’t go into details (particularly since, with the exception of my beloved Slope Plus subscribers, you slobs show up here and get all this content without giving me a penny), but the principal point is that these bearish predictions are coming from people whose news typical disappoints me (e.g. they are very steadily bullish).

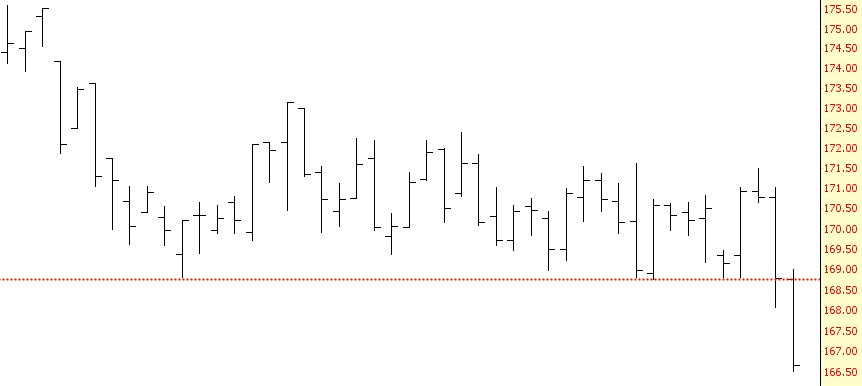

One item that surprised me somewhat is that interest rates are rising, and yet that’s no longer inspirational the stocks. In other words, bonds are starting to fall to pieces, and whereas until recently that was a boon to stocks (and financials in particular), it clearly hasn’t had that effect lately. Here’s the front month of bonds losing support on Friday:

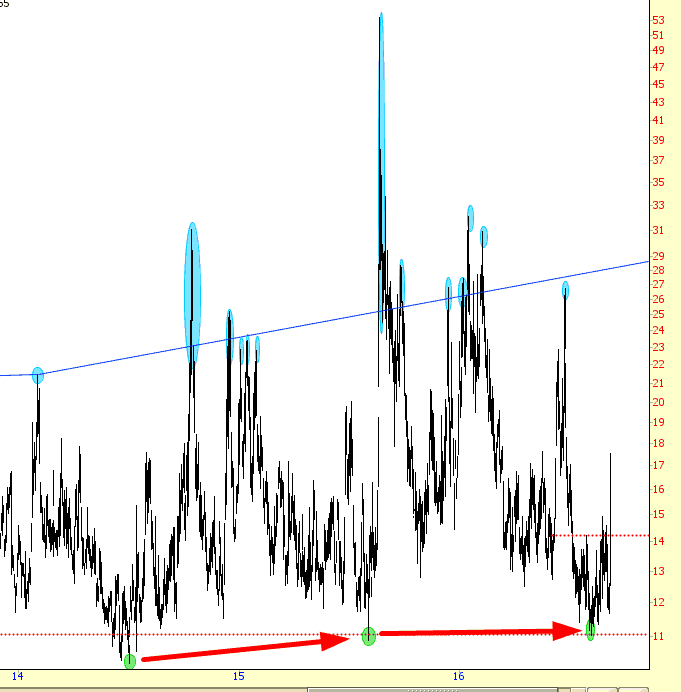

The VIX, which had been comically and ridiculously approaching the single digits, exploded in an orgasm of excitement Friday, having come off a “green dot” on my chart. Naturally, what I’d like to be able to paint later is another blue dot – – – one of those huge spikes into the upper 20s, 30s, or even higher. Let panic reign!

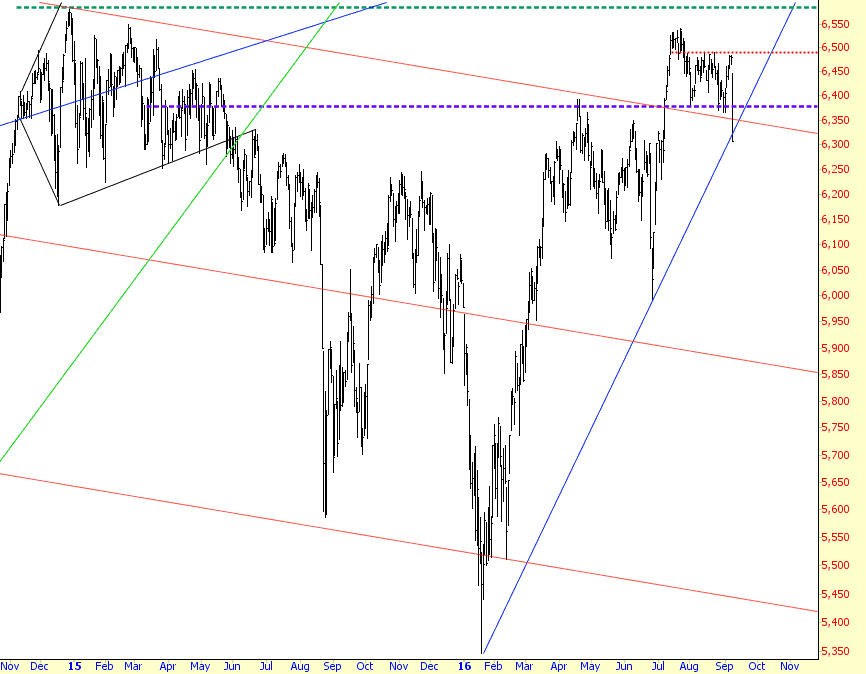

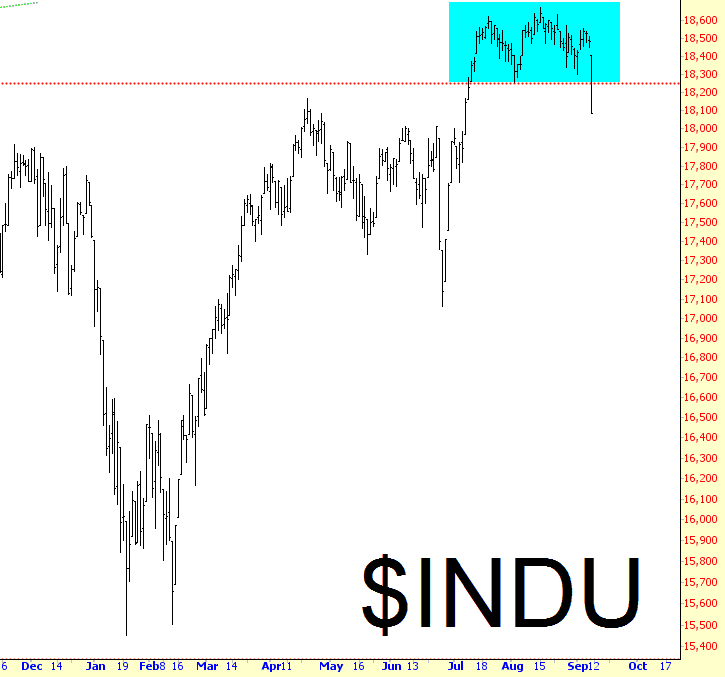

The BTFD mentality is deeply ingrained, however, and many times on Friday I saw Slopers exclaiming that the bottom was in. The market would rally for a few minutes, causing them to tout their right-ness……….only to fall yet more. I’m glad I ignored them. The risk of a bounce early next week is quite real, but I think the damage on Friday was serious enough that such a bounce would be a sucker’s rally. Here’s the Dow Composite:

Looking closer at the same index, I suggest a possible wild-assed guess would be a lift on Monday to what is now resistance, followed by a heartier fall – – perhaps giving the anti-Christ political cover to do God-knows-what on the 21st. She’s a sinister vermin, and she may even be the one allowing this drop to happen in the first place, just to empower her for a while longer.

The Dow itself has already exhibited a failed bullish breakout, having finally escaped from the holy-God-this-is-boring range in which we were trapped for what seemed like years.

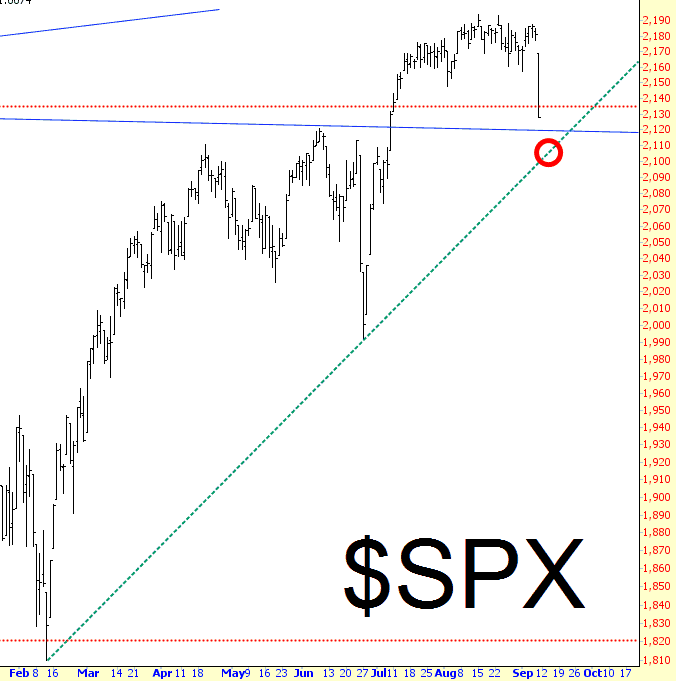

If weakness simply continues, the next important point to watch is the trendline on the S&P 500, which is at something like 2100.

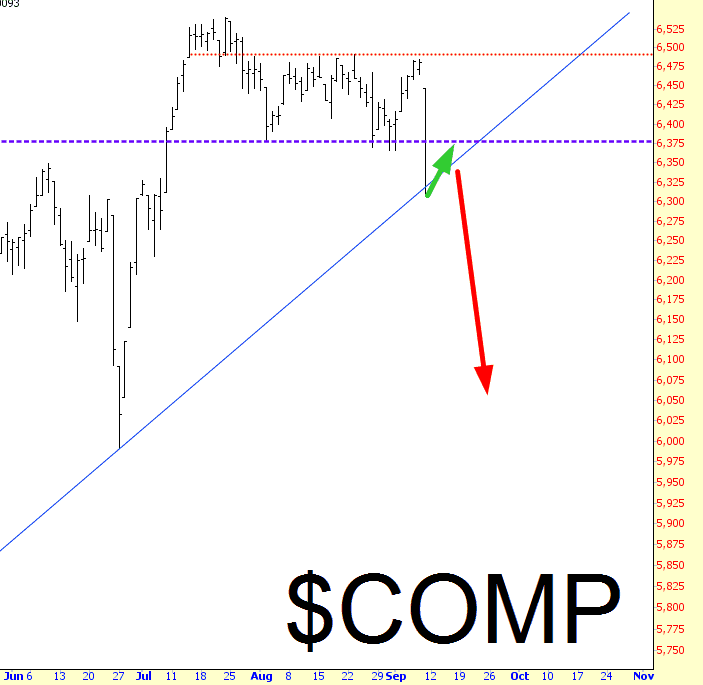

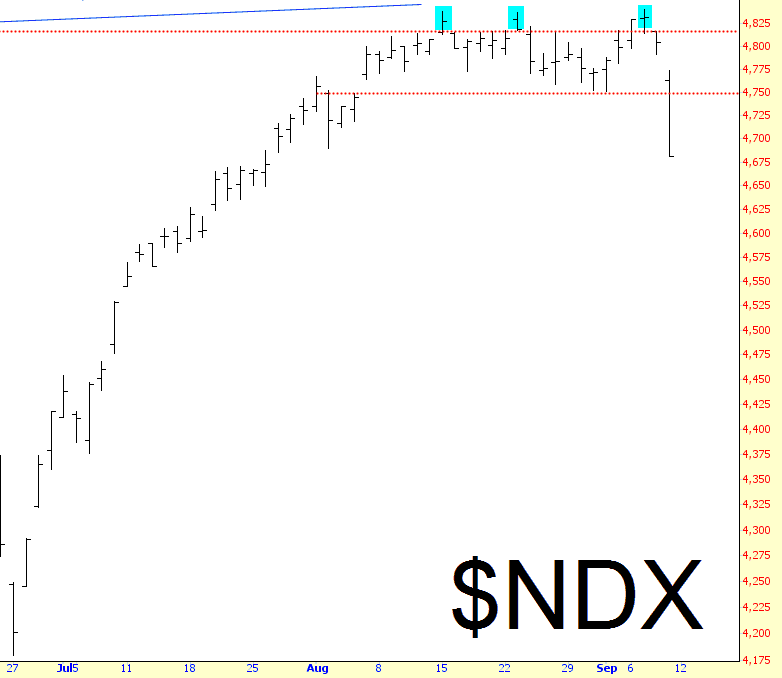

Finally, the Apple product announcement gave the NASDAQ 100 its third attempt to show what strong FANGs that market has, but each of those third lifetime highs was an island unto itself. Tim Cook’s lame new marginal improvements to his product line are boring, and no one cares.

We’ll close with a pleasant melody to buttress the title of this charming little post. I will try to be well-behaved during the 15th anniversary of the terror attacks tomorrow, but sometimes my passions overtake me.