In case you missed it, I did a post last night talking about the pattern structure and timing on SPX/ES, NQ and TF, and if you missed that you can see that here.

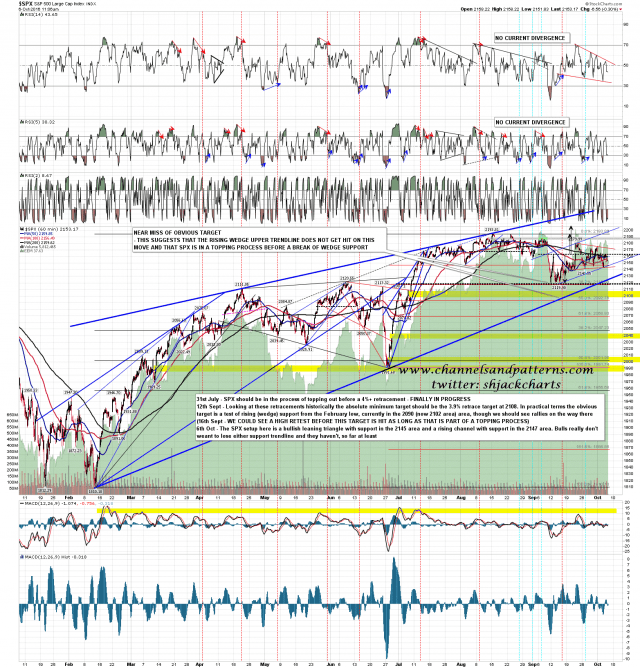

Another slowish day on ES/SPX. No support breaks yet and the ES weekly pivot at 2154 (2162 SPX area) may be being converted to support, but not with any real confidence yet. Both SPX and ES are in a rising channel and a triangle, but are running out of time to do the obvious next step of a break up into a retest of the all time high. The high window on SPX lasts until the close tomorrow, with a possible spill into Monday, but unless we see some upward movement soon, this is just a consolidation before the next leg down. SPX 60min chart:

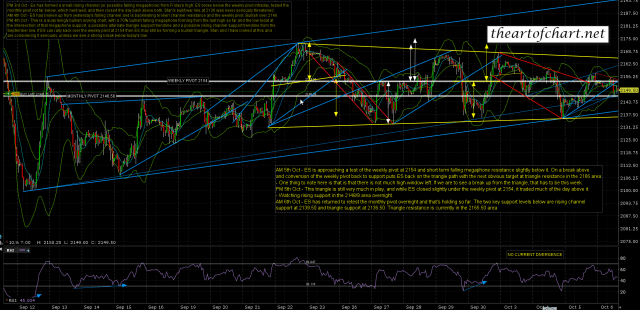

ES Dec 60min chart:

How confident am I that the high window will deliver? Well there’s no such thing as a sure thing but the setup for the decline we expecting is in place already, and historically these cycle windows deliver well. If we don’t see a break up from the triangle today or tomorrow then my working assumption will be that the next break will be down.

We’ve been doing a promotion the last few weeks before a price rise at theartofchart.net, and that’s gone very well. That promotion is ending on Sunday and I won’t be marketing much again before Xmas I think, because we’ll need some time to get the new subscribers bedded in before we are ready for the next group. If you’d like to lock in the current lower prices then you have until Sunday to do that. If you’d like to try the 14 day free trial then you can find that here.