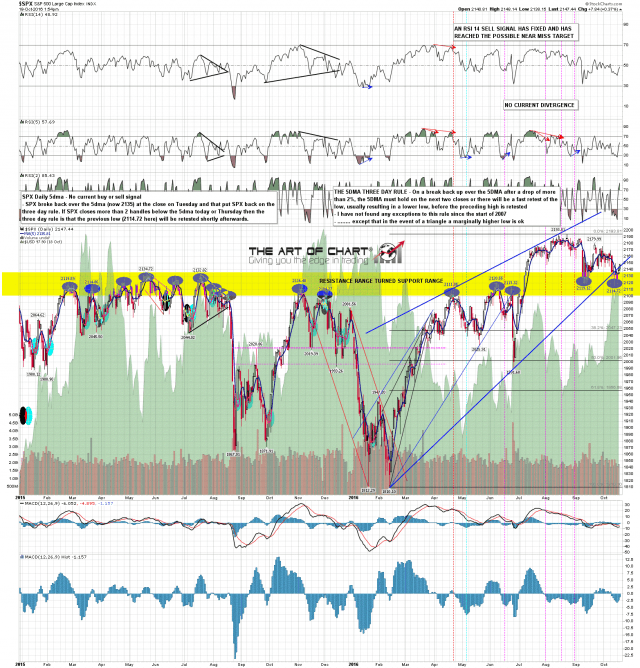

Yesterday’s close was a break back over the 5dma, so SPX is back on the three day rule. In the event that SPX closes more than two handles below the 5dma today or tomorrow, then the 2114 low would very likely be retested shortly afterwards.

One thing that’s very interesting on this chart below is the support/resistance zone highlighted in yellow. Since the start of 2015 that has held an impressive 14 short term highs and we could be looking at the second low since it was broken.

The important resistance level at the 50 hour MA at 2137 has been broken and SPX has come close to testing the daily middle band at 2152. On a decent break over the daily middle band with a confirming close above the following day this low is likely in, but until then we are expecting another leg down. That might just deliver a marginal new low though. SPX daily 5dma chart:

On ES Stan called 2143 as important this morning, and that’s held as resistance so far. I’m also watching the monthly pivot at 2146 and in the event that is converted to support, we are looking at a possible triangle resistance trendline in the 2156/7 area. We’ve been getting a lot of triangles lately and this may just be another. ES Dec 60min chart:

We’re expecting another leg down to finish this move. That may well not get through the support range marked on the top chart. No sign at the moment that the bears can deliver anything lower than that. After a low in the next few days we are then seeing a bull window into Thanksgiving & we’ll see then if bulls can do better.