Equities and other risky assets will likely sell-off hard fairly soon. I consider it highly unlikely that sustained upside progress can be made.

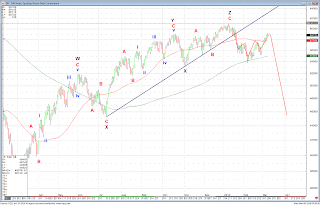

Below is a daily chart of the German DAX. This is my count and projections, unchanged from January 2010.

This is an hourly chart of mainland Chinese large caps traded in Hong Kong (the H-shares index). This index is weaker than the Hang Seng, and failed to take out the resistance highlighted by the red box. From Elliott Wave perspective, the rally from February lows has been corrective and is very likely over at current levels. This index is putting in a massive, massive top. All this for the companies that cater to the market that will save the world in 2010???

This is an hourly chart of mainland Chinese large caps traded in Hong Kong (the H-shares index). This index is weaker than the Hang Seng, and failed to take out the resistance highlighted by the red box. From Elliott Wave perspective, the rally from February lows has been corrective and is very likely over at current levels. This index is putting in a massive, massive top. All this for the companies that cater to the market that will save the world in 2010???