How poor is the outlook for equities? Very, very poor. It is a disaster waiting to happen. While in the short-term marginal new highs are possible for most indices, in the medium-term risk and related assets are likely to face substantial difficulties moving higher, and will most likely move lower swiftly.

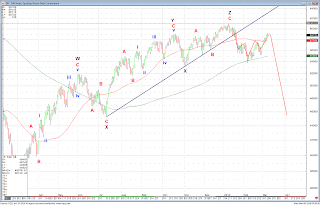

Below is a daily chart of the German DAX with my projections from 15 January 2010. So far, everything has been unfolding according to plan. If this continues to be the case, for which there is ample evidence, I believe we will see this index about 20% lower in the next 5 or so weeks.

This is an hourly chart of the Hang Seng Index in Hong Kong. It is currently trading at levels first achieved in August 2009 – fully eight months ago. As you can see, the index is firmly parked in a range (highlighted by the black box) that acted as support and resistance during those last eight months. From Elliott Wave perspective, the rally from February lows has been corrective and is very likely over at current levels. This index is putting in a massive, massive top.

This is an hourly chart shares of mainland Chinese large caps traded in Hong Kong (the H-shares index). This index (also shown on a daily time frame on the last chart in today's post) is weaker than the Hang Seng, currently trading below the price range, highlighted by the black box, that acted as support or resistance since August 2009. From Elliott Wave perspective, the rally from February lows has been corrective and is very likely over at current levels. This index is also putting in a massive, massive top. All this for the companies that cater to the market that will save the world in 2010???

This is an hourly chart shares of mainland Chinese large caps traded in Hong Kong (the H-shares index). This index (also shown on a daily time frame on the last chart in today's post) is weaker than the Hang Seng, currently trading below the price range, highlighted by the black box, that acted as support or resistance since August 2009. From Elliott Wave perspective, the rally from February lows has been corrective and is very likely over at current levels. This index is also putting in a massive, massive top. All this for the companies that cater to the market that will save the world in 2010???

H-shares index in Hong Kong is about to put in a "death cross" of 55 day moving average moving below the 200 day moving average for the first time since March 2008.

Originally published on http://observemarkets.blogspot.com/