I wasn’t planning a post here today but I have more time than I expected this morning, and I didn’t manage to do the AAPL post I was planning yesterday, so I’m going to combine them both into a single post here this morning.

I’m rolling into the December contract over the weekend, so if you’ve rolled already then I’ve put the spread between the September and December contracts on each of the ES, NQ & TF charts below. All three charts were done and posted last night for subscribers at theartofchart.net.

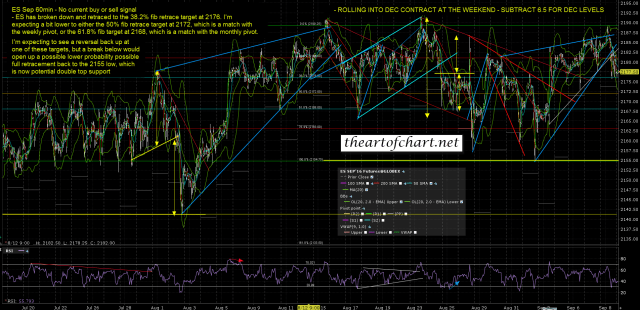

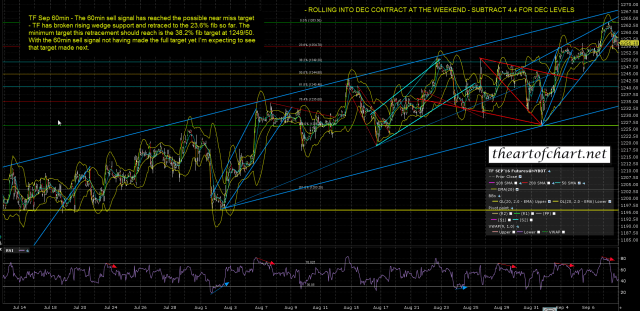

At the time of writing all the key support levels that I was looking for at the time I did these charts are being tested. ES has made the 61.8% fib retrace and is testing the monthly pivot at 2168 (2161.5 on ES Dec). NQ has made the double double target at 4783, and is now testing the monthly pivot at 4763 (4759 on NQ Dec). TF has made the obvious 38.2% fib retrace at 1249/50 (1245 on TF Dec). These are big support levels, and given the timing on the cycle windows I’m expecting a reversal back up to new highs here.

What happens if support isn’t found here? Well ES has a possible double top formed here that on a sustained break below 2155 (2148.5 on ES Dec), would target the 2121 area (2114.5 on ES Dec). NQ has another possible double top setup that on a sustained break below 4750 (4746 on NQ Dec) would target the 4660 area (4656 on NQ Dec), and TF has established support levels in the 1246 (1241.6 on TF Dec), 1226.5 (1222.1 on TF Dec) and 1196 areas (1191.6 on TF Dec). The big target would be the lowest as that is a possible larger H&S neckline.

How likely is it that we could see an early break down? Well the current degree of compression on SPX is unprecedented as far as I’m aware, and it gets harder to call moves when you are in genuinely uncharted territory. It’s certainly possible that we could see that here, and as I’ve been saying for weeks, the obvious direction to see that coiled energy released into is a break down. We’ll see whether support holds here. If it doesn’t I’d be wary of buying the dip and I’d note that today is a cycle trend day, so if support breaks and bears can locate their car keys, this decline could potentially last all day and set up further declines over the next few days.

I would note that the mini-crash a year ago followed a compression that was considerably smaller than this one. We’ll see. Until support is broken with conviction the obvious lean is bullish. If it breaks with conviction then all bull bets are off.

ES Sep 60min chart:

NQ Sep 60min chart:

TF Sep 60min chart:

If you’ve been reading my blog for several years you’ll probably recall that I used to follow some stocks regularly and (buffs fingernails modestly) some of my calls on stocks were pretty impressive. As Stan and I are launching our new Big Five service next week at theartofchart.net, I thought I’d dig up some of those older posts to show that Stan and I, as he has done a lot of work on stocks in the past too, are not in unfamiliar territory with these.

Browsing through these, some of my favorites are my low call on BP in June 2010 at the time of the big oil spill, you can see that post here. It bottomed the next day I think. Another is my call in January 2011 for GS to drop from $165 to under $100, with it halving in value over the next nine months. You can see that post here. Another is my call in May 2011 that major support had broken on RIMM (now BBRY) and looking at a 50%+ drop there, after which it fell almost 90% over the next year. You can see that post here. All of these calls were the sweeter for fundamentalists arguing strongly with me when I made them that these purely technical calls would never deliver for fundamentals reasons.

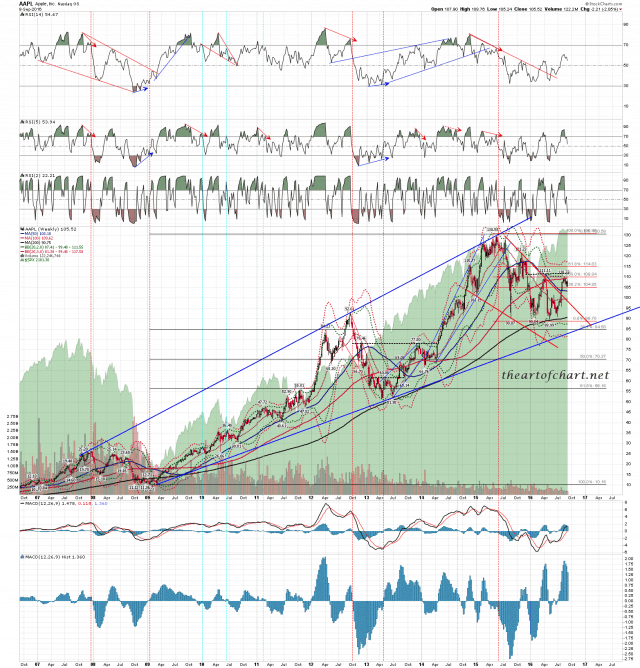

As the Big Five service that we are launching covers AAPL, AMZN, FB, NFLX and TSLA though, I’m looking at my past work on AAPL today and I’ve an example to show that has a relevance here that I’ll explain.

It started with a couple of posts in October 2012, when I did a post talking about the negative divergence on the AAPL weekly RSI 14 and the history of similar divergences on AAPL. You can see those posts here and here. My point was that there had been five similar weekly sell signals on AAPL over the years, and the smallest decline delivered by the signal has been 15% in 2011, with the next smallest after that being a 42% decline in 2006. This was a controversial post and you’ll note that I was sounding a bit defensive on the second one. The subsequent decline into April 2013 was a whisker under 44% and I called the IHS low setup in a couple of posts in May 2013, which you can see here and here.

What’s the relevance to AAPL today? Well you can see that AAPL is once again on a weekly RSI 14 sell signal, and that signal has made the possible near miss target with a peak to trough decline of 31.85% so far. That’s undersized as 5 out of the six previous examples delivered declines over 40%. I’d note that rising meghaphone support is currently in the 83 area and that a test of that trendline in the 83.5 area would bring that up to a still undersized but better 36% to 37.5% decline. We are expecting to see that trendline hit, though probably not directly from here. We’ll be laying out what we are seeing as the likeliest path to get there over the next few months at our free webinar to launch the Big Five service after the RTH close on Monday, and you can register for that free public webinar here. AAPL weekly chart:

Going back to SPX/ES, today is an important support test and on a conversion of the monthly pivot to resistance the high that we are expecting in two or three weeks may already be in. This tape is highly compressed and if we see an expansion to the downside start here then the tape could get wild. If that is starting and you aren’t already short, I would be very careful and look back a year to see what could happen here if the gap down today becomes an unfilled breakaway gap down. Trade safe.

I’m out for pretty much the rest of the day. Everyone have a great weekend. 🙂