Bears started off with a great setup today with an H&S breaking down with a target at 2107.5 (approx 2113/4 SPX), and just a bit more work needed in the first hour to deliver a trend down day. They entirely failed to manage that, and ES has drifted up slowly the rest of the day. This may have been the bears’ last decent chance to make lower low on this move as the low window ends on Tuesday. It was very likely the last chance to start a move that could break 2100 with any force. ES Dec 60min chart:

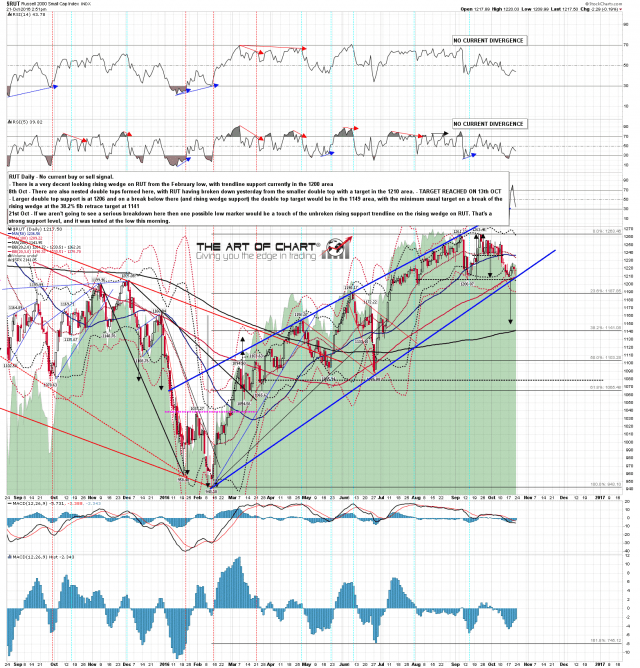

I was looking at the RUT chart last night thinking that we had to see at least some more downside just to test rising wedge support on the unbroken rising wedge from February there. That’s no longer unfinished business below, and that test at the low this morning may mark the technical end of this retracement. RUT daily chart:

This pullback has been a very muted affair and bears have essentially wasted their window here. The next window is a bull window that should stretch into Thanksgiving. I’m going to be positioning for that early next week. I’d suggest not getting too married to any short positions. If that RUT wedge support holds then the next target there will be a retest of the all time high at 1296. That might be the next interesting short area. Everyone have a great weekend 🙂