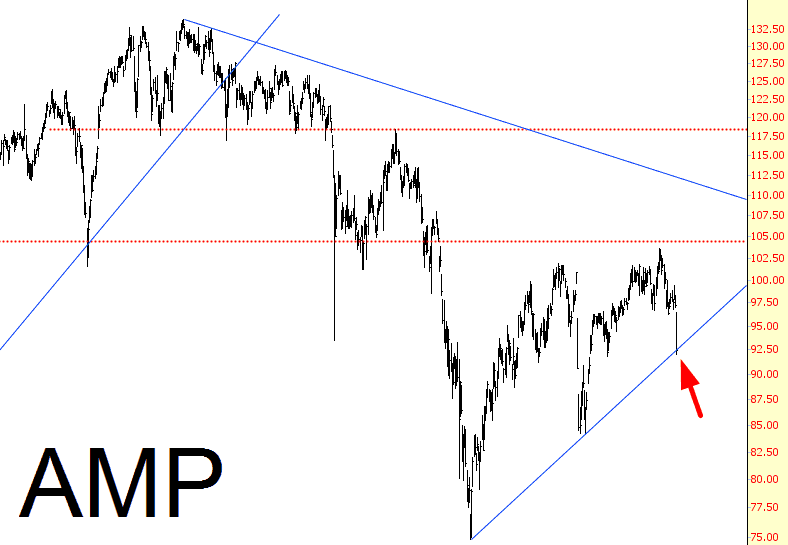

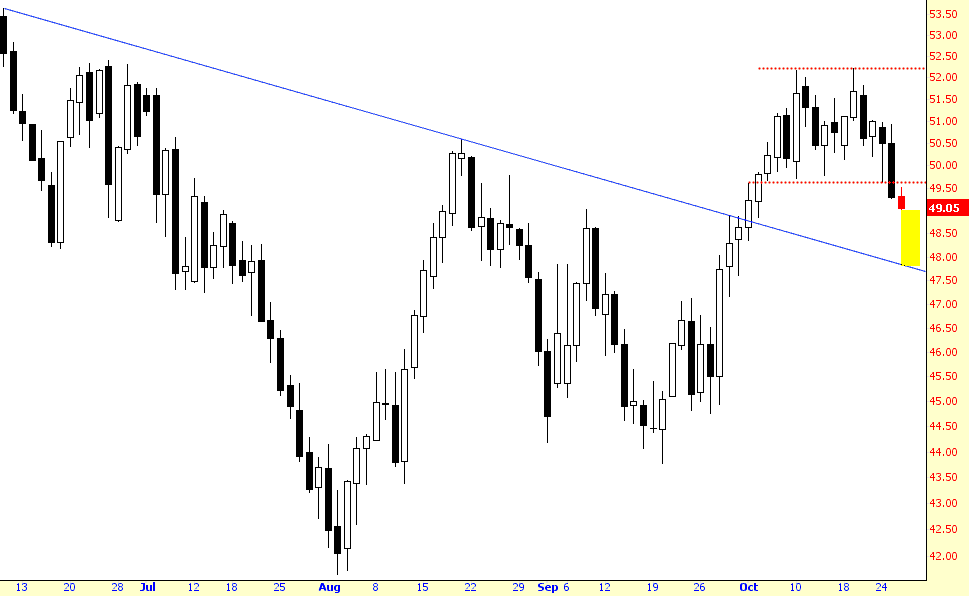

I covered Ameriprise for a nice profit this morning, as it has touched its supporting trendline. I suspect this same trendline will eventually be broken, but I’d rather try to re-load the short at a higher price. (I should note that since I’ve posted this chart, the chart has sunk beneath the trendline, so I’ll probably wish I’d just stay short in perpetuity!)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

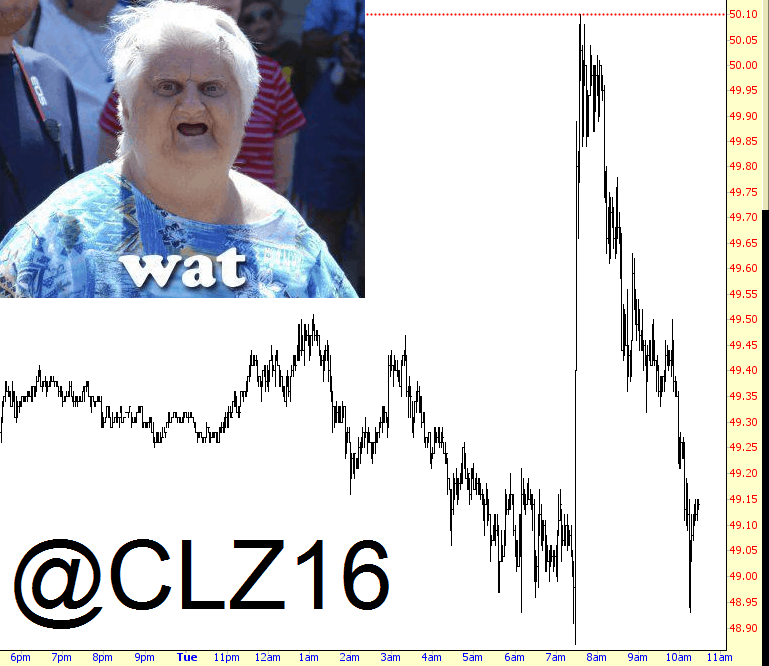

Crude Rally Totally Torched

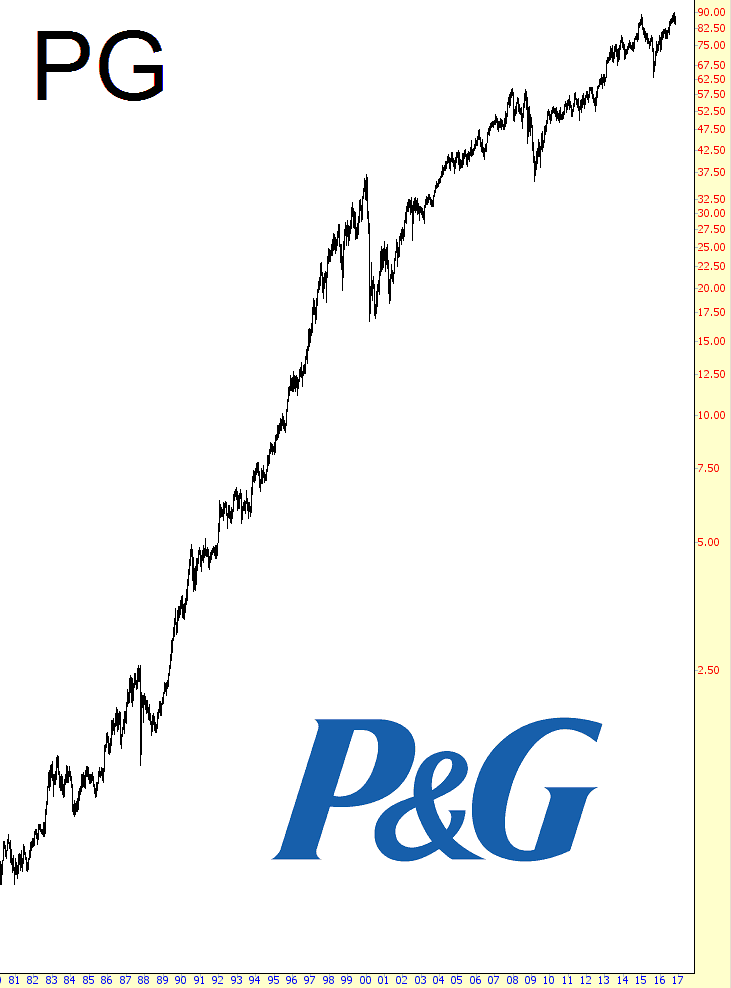

The Buy And Holdiest

Let us all bask for a moment in the ever present glow of Procter & Gamble, which must be one of the most incredible stocks of all time. In this frothy market of ours, this maker of laundry soaps and dishwashing liquid sports a P/E of about 25, which back in the day was the sort of level reserved for high-tech companies. Anyway, the great crashes of the past few decades are hardly blips in the ascent of this monster.

Slippery When Wet

Since the highest concentration of my positions is in energy, I’m persistently interested in the price of crude oil. It seems to have finally, after weeks of being range-bound, broken to the downside. However, I don’t think the downside potential is that vast – – – probably something confined within the zone I’ve tinted below.

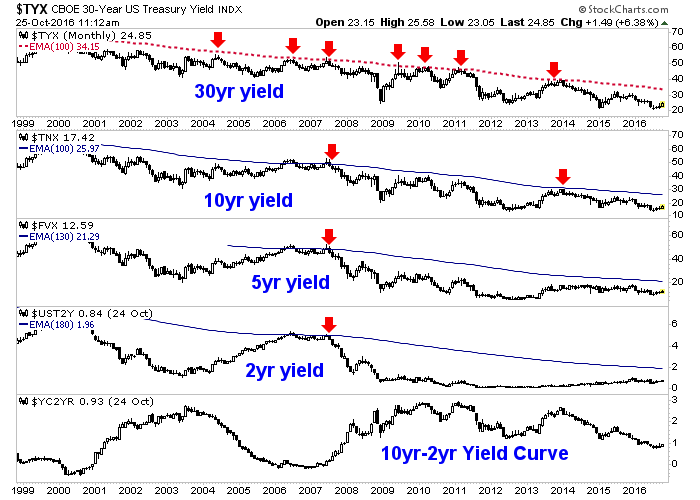

The Current Message of Yield Curves: Inflation or Deflation?

With the state of post-Op/Twist systemic dysfunction, there are no absolutes, but…

Generally, a rising yield curve (after years of Goldilocks and her favored declining curve) would signal changes in financial markets. But it is not as simple as stating ‘the curve is rising… it’s bearish!’ or ‘the curve is rising… it’s bullish!’. It is potentially both of those things and it will have different implications for different markets and asset classes.

First, here is the state of yields and the yield curve currently, on the big picture view. Trends are down in the deflationary continuum on the biggest picture for all items, but have been neutral on the 5yr and somewhat up on the 2yr ever since Goldilocks gulped the bears’ porridge in 2013. The yield curve is in a downtrend.