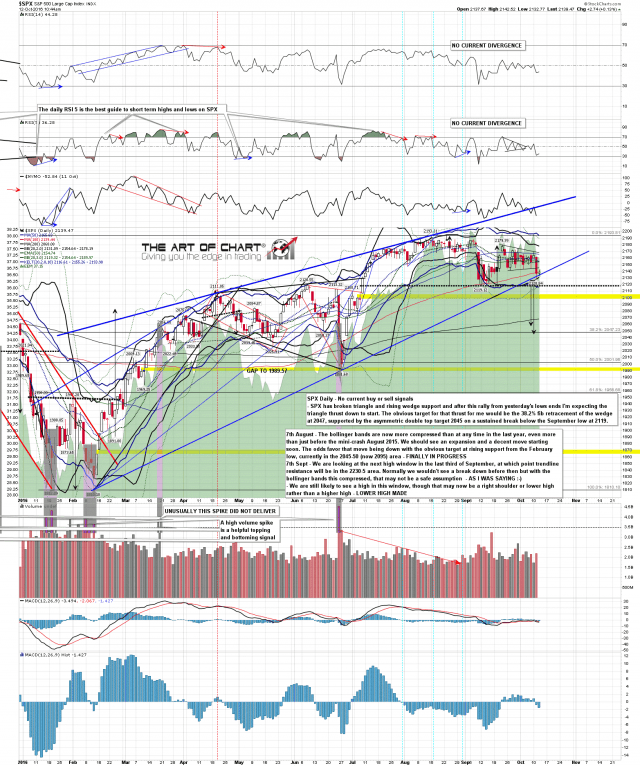

The bears did a lot of technical damage yesterday, and managed to both break down from the SPX triangle and briefly break below rising wedge support from the February low. I’m expecting more downside.

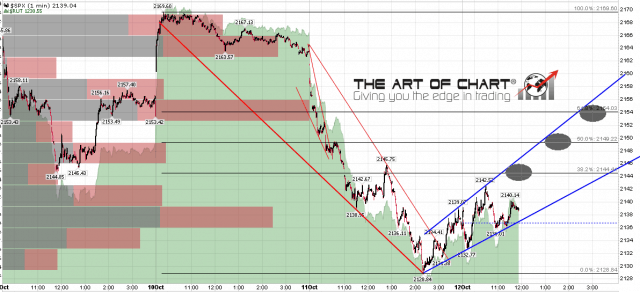

When a triangle like this breaks there is a sequence from that break. First there is a backtest of broken triangle support, often going back into the triangle, and we are watching that at the moment. Then the main thrust out of the triangle starts, and after that ends, the thrust is usually fully retraced. So far the backtest is forming a very decent looking shallow rising megaphone that is very likely to be a bear flag on this setup. When that breaks down the main triangle thrust down should be in progress. SPX 1min chart:

The double top on SPX isn’t great quality, but it’s supported by the much better quality double-tops on NDX and RUT. The double top target at 2045 is also supported by the 38.2% fib retrace target for the rising wedge from the February low, as that is usual minimum target on a break down from a rising wedge. SPX daily chart:

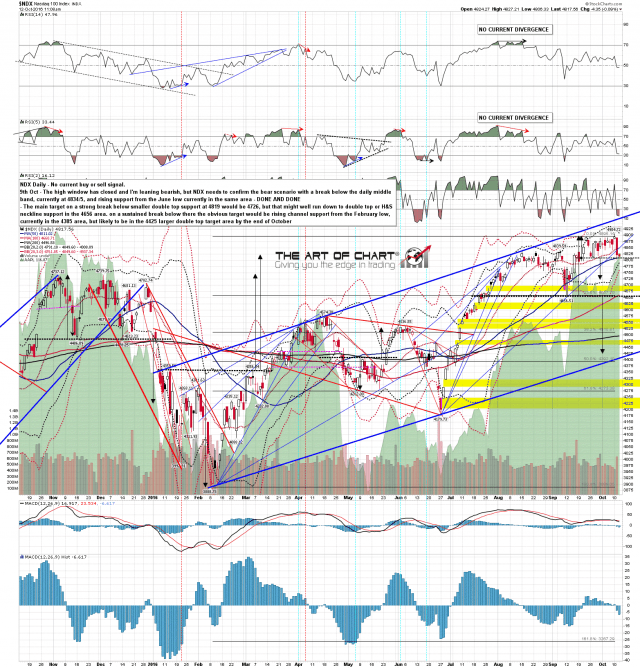

The very nice looking double top setup on NDX has the potential to run a lot lower. NDX daily chart:

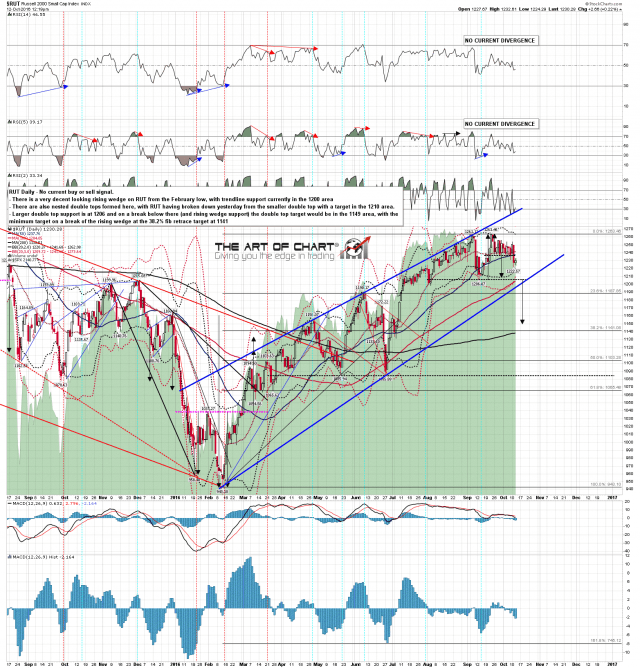

The rising wedge on RUT hasn’t broken support yet, but the double top setup is a beauty, and I’m expecting this to play out. RUT daily chart:

More notes and numbers for levels and targets are on the charts, but that’s the plan for most of the rest of the month. The low window opens on the 21st October and runs through until the end of the month. After that we are confidently expecting this triangle thrust to be entirely retraced, so don’t get too married to the short side. 🙂