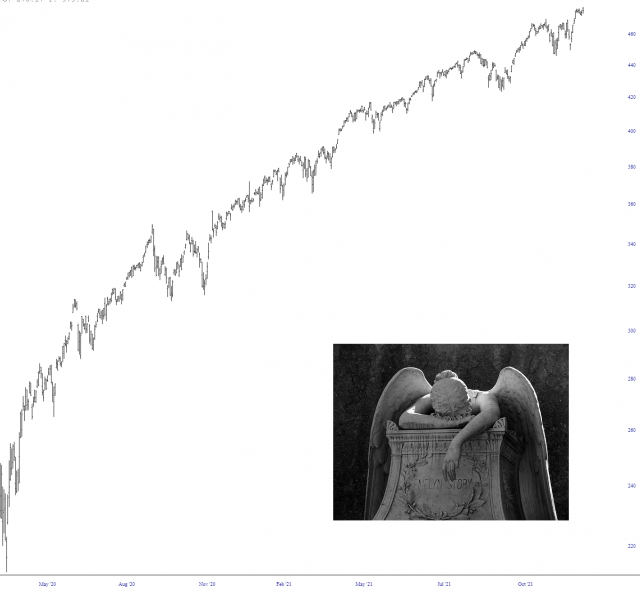

I was reflecting last night on how lucky we are now. Only last year, the market looked like this. Sort of what I called “A Living Hell on Earth”:

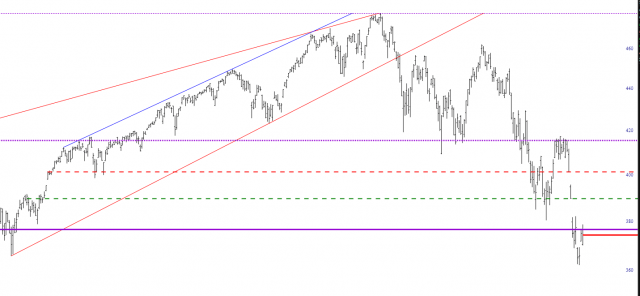

Now we’ve got an actual, honest-to-God, two-way market on our hands again. You know, the real thing. The thing that anyone who hasn’t been trading for at least 20 years has no idea what to do with.

Of course, being a two-way market, things go up, too, and that’s all right. As we’ve been strengthening for the past week, volatility has been flying out the window, beaten down from the 30s to the 20s.

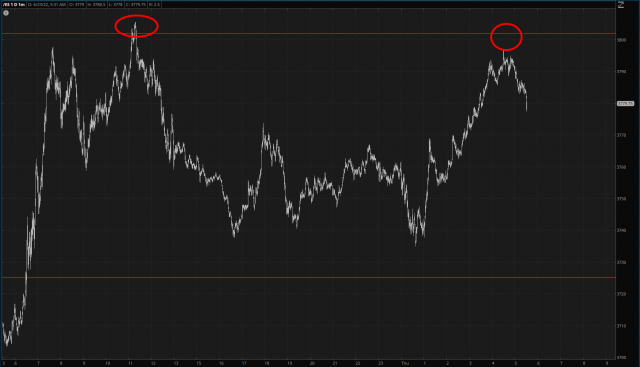

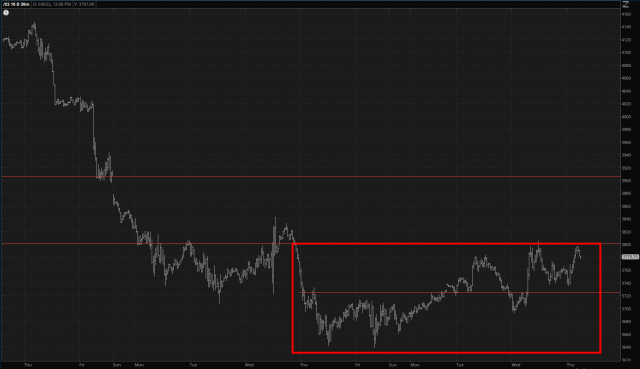

The cool thing (thus far, at least) is that the bulls simply cannot reach escape velocity. Whether you’re looking at the /ES, , /NQ, or the /RTY, the bulls get RIGHT close to the breakout point, and then they go limp. It happened yet again last night. Indeed, the lack of energy presently means they don’t even make it to the prior high. They just sort of get close.

In doing so, what would normally be a powerful bullish base turns into a chop-fest.

My point is that as long as this pattern fails to complete, the bears remain very surreptitiously in control.