Germany As The Key

In a recent post (Nord Stream 2 and the Ukraine War),

I mentioned Mike Whitney’s assertion that the United States welcomed the Ukraine War as a way to cancel Nord Stream 2 and build a wedge between Russia and Germany:

Whitney may have overstated the case a bit there, but his opening quote is apposite:

“The primordial interest of the United States, over which for centuries we have fought wars– the First, the Second and Cold Wars– has been the relationship between Germany and Russia, because united there, they’re the only force that could threaten us. And to make sure that that doesn’t happen.” George Friedman, STRATFOR CEO at The Chicago Council on Foreign Affairs

It’s also worth noting that this has been the “primordial interest” of Great Britain for far longer than it has been for the U.S.: to keep any one power or alliance of powers from dominating Continental Europe. That puts Britain’s enthusiasm for a policy that is wrecking Germany economically in a different light.

A few days ago, the controversial Finnish-German internet entrepreneur Kim Dotcom offered his take on how Germany could end the Ukraine War. I’ve included his Twitter thread on this in full below. Following that, I’ll add a brief example of the Portfolio Armor approach to investing recently, as the economic fallout from the Ukraine War has piled up.

Kim Dotcom on Ending The Ukraine War

Investing Cautiously in the Meantime

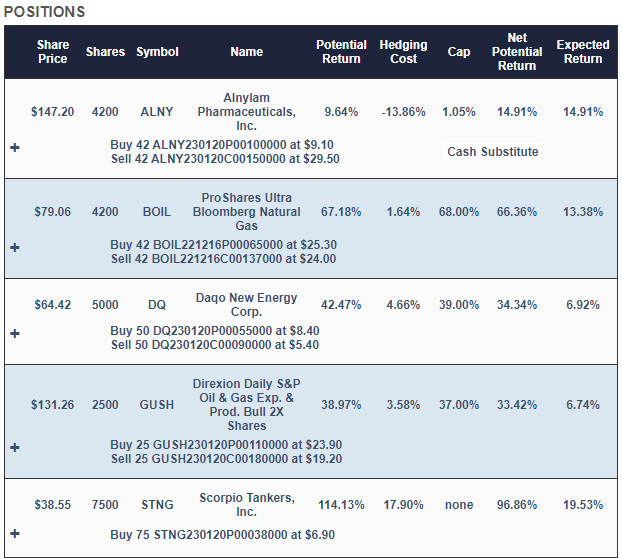

Here’s an example of our recent approach to investing as the economic impact of the Ukraine War and associated sanctions regime has reverberated through the global economy. This was a hedged portfolio our system created on July 21st for an investor who was unwilling to risk a decline of more than 20% over the next six months.

Screen captures via Portfolio Armor on 7/21/2022

This portfolio included energy names such as GUSH, BOIL, and DQ, along with bearish ETFs TTT, TMV, and WEBS (which shorts internet companies). The Max Drawdown, or worst-case scenario for this portfolio was a decline of 19.25% if every underlying security went to zero. The expected return here was a gain of about 10% over six months.

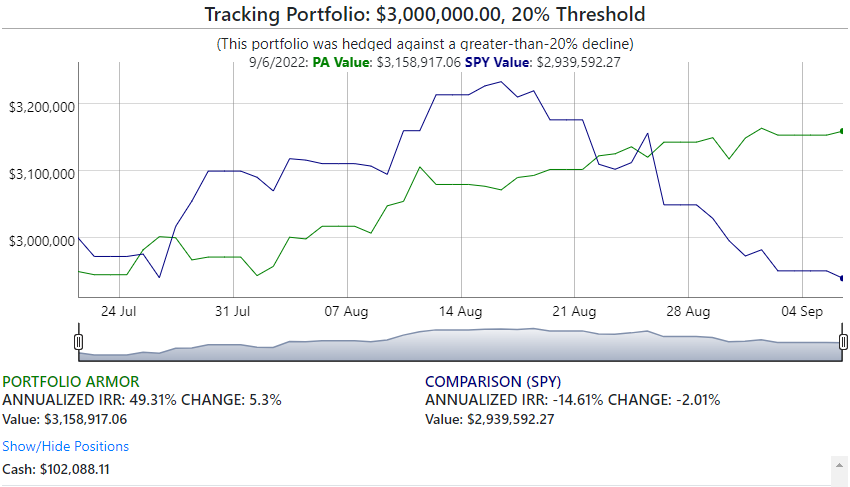

Here’s how that portfolio has done so far, as of Tuesday’s close:

So far, this portfolio is up 5.3%, net of hedging and trading costs, while SPY is down 2.01%.