My usual posts would focus on a specific direction in the market (and for about a year now, most of the time, that direction was down). But after today, I honestly have no clue where we go. From a strictly technical perspective the charts have been very muddied with the action this week. I’ll go into this first and discuss fundamental changes next.

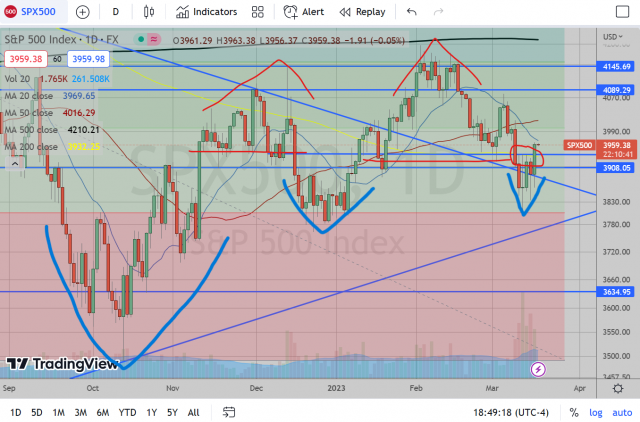

SPX daily chart. My hope was that we finally saw this rejection of the 3900 with the daily red candle last Friday. We had two enormous tops from November-December 2022, then another one January to February 2023 marked up in red. In fact, the technical resistance is actually still intact (but the bearish case is certainly weakened with the green bar today). On the flipside, we have 3 supportive higher lows marked up in blue. So there are 2 very conflicting but equally valid technical assessments on this chart. I’ll zoom in for a closer look.

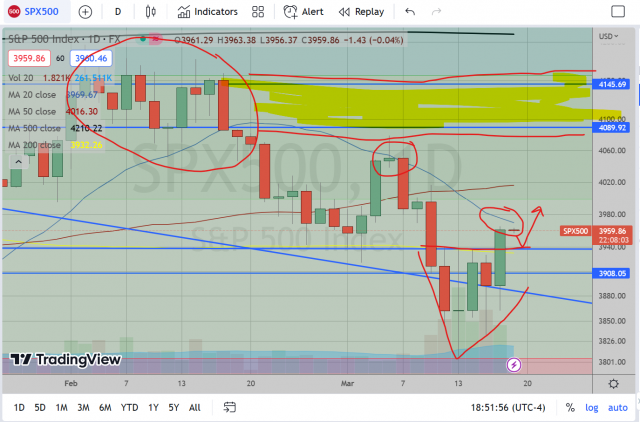

Zoomed in we can see the short-term technical setup that we are now facing. After the drop last Friday I suppose everyone must have thought this was THE drop (including me, obviously). Resistance held extremely well for 3 days straight at 3940, which makes today’s break above that much more scary as this is a technical breakout. With the winds in the bulls’ sails I would tread carefully and manage any remaining shorts appropriately (selling options, covering positions and shoring up cash, etc.).

However, even here, there is some short-term resistance very closely above. We are almost exactly at the March opening price of 3964 and we have the 20 Day MA right above at 3969. I usually wouldn’t put too much weight on the shorter-term averages with this much strength but it managed to hold beneath earlier in March so we must watch it now.

That being said, if we do manage to see any weakness I would need to see the failure at 3940 to maintain my bearishness. The most immediate danger is it may only pull us back to 3940 as a retest of this breakout pattern and shoot us higher in which case the 4100-4200 zone is back on the table. So, again, muddy waters to wade through as there are technical setups galore in both directions.

On the weekly chart we can see again very important potential resistance at 3970. This was the weekly close in the 2nd to last week in January and the last week in February, just above the March open as mentioned above, and we have the 20 AND 50 Week MA just around this level (3968 and 3977 respectively). Again on the flipside, however, is that very bullish bounce off 3940 area which was such a powerful consolidation pattern back in late December. Very muddy indeed.

There are 11 trading days left in this month in which a lot can happen. Should the short-term bullish patterns breakout then this will then turn the weekly and even the monthly bullish (if we break above 3970).

But which way to place your bets? While I am less skilled at interpreting the other facets of economic indicators which may drive the market, I will provide some food for thought.

Quantitative tightening has been the story since the beginning of 2022. While this successfully has pulled us away from the market highs, we can’t seem to make the drop that, I must say, I am salivating for. What happened? This week seemed to be THE week. Banks were failing left and right and fear finally appeared to begin to grip the market.

To be clear, the story is not “oh poor banks, simply got caught off guard by rapid rate increases and my booboo hurts”. No. These banks were overleveraged and undercapitalized for the types of liabilities they had and any decent Risk Manager (and regulator) should have caught these banks and reversed these actions years ago (I do NOT want to get into a political discussion on this, but when boiled down the main issue is that regulators simply stopped watching these banks because they didn’t have to).

Instead, we are now hearing the real stories, the executives, while not explicitly fraudulent, were acting very irresponsibly, got caught with their pants down, SOLD STOCK BEFORE THE STOCK FELL, and let the companies fall as they may.

And in any true capitalist free market economy we should be allowing these banks to fail (and possibly throwing these executives in jail). Sure, we should be seeing some mergers/buyouts, rescues by other bigger banks to gobble them up. But instead we got bailouts (which I will also note the phrase “won’t cost the taxpayers”, which sounds like the biggest load of bullshit I have ever heard).

And as Tim (and others) have pointed out, this is yet again just another form of QE. We are pumping trillions of dollars back into the economy by way of direct injection into failing banks. I don’t know much more to speculate on other than this fundamentally changes the game. Where we had a pretty good direction due to QT, now we have this backdoor QE. The Fed is essentially tightening with the right hand while easing with the left.

If the old saying goes “Don’t fight the Fed”, how the hell are you supposed to trade with the Fed if they are going in both directions? Well, I suppose you’d have to lean in with the crowd and say “fine”. It may be time to start leaning bullish (God that feels wrong saying that). Does that mean I am covering my short positions tomorrow? No. I have my stops in place and I am letting them do what they are meant to do. But should I end up covering my positions, I will have to start looking for bullish setups or wait for a much better short set up as this sideways market for almost 11 months is simply too obscure at this point to use the usual technical indicators (for me at least).

To summarize, the technical setups are all over the place. Arguments can be made for both directions. Fundamentally, we now have this QE that is not QE (but if it walks like a duck, quacks like a duck…). And when the market is this goosed up, the deck is stacked against you, maybe it’s time to just bet against the obvious odds (maybe).

If you are nimble enough then you know this is a day trader’s market. Jumping in an out, bounces and pullbacks seem to be yielding very good profits in each direction. For those of us forced to buy and hold (or sell and hold), we obviously know we haven’t gone anywhere in almost a year. Well, maybe next month will be our month.