I’ve got to say, I was wrong about crypto – – or, more specifically, wrong about Bitcoin and Ethereum. To be clear, I still think crypto is useless, but maybe we’ve found a very specific niche case where it excels: that is to say, a reliable safe haven for fixed assets (a digital gold, some have called it). There’s no arguing with the stellar performance of Bitcoin this year………..

……or Ethereum……….

My views on crypto, I think, are fairly subjective, because I haven’t touched the stuff for about 18 months. So whether BTC goes to $100,000 or $5 doesn’t affect me directly at all.

As a chartist, I’ll say two things about the chart below: on the one hand, there is a staggering amount of overhead supply, ranging from its present price level of about $27,000 all the way up to $70,000. That is a monstrous amount of resistance. On the other hand, the basing pattern it has formed is pretty impressive. So we’re in “face-off” mode right now. Shorter-term, the Fibonacci at about $29,000 is formidable.

The same goes for Ethereum: a terrific basing pattern, but it isn’t going to be a walk in the park to move higher.

Gold has likewise been one of the few assets on the planet thriving over the past couple of weeks. If I absolutely had to choose between Bitcoin and Gold, I’d probably just go with Gold, because it’s much closer to lifetime highs, I can hold it, and it doesn’t require computers, network, and electricity. Again, as a chartist, I’ve got to point out it’s approaching important resistance, but it has a much easier time of it, since it doesn’t have $43,000 of higher prices to cut through to reach new highs.

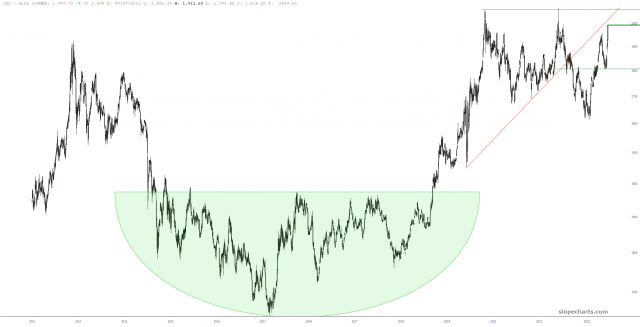

I’ll close by saying this: if I lived in Japan, I would absolutely want to own gold. Below is the futures chart of Yen-denominated gold. THIS, my friends, is what I called a BULLISH CHART! No asterisks. No quibbling. It’s a freakin’ BUY.