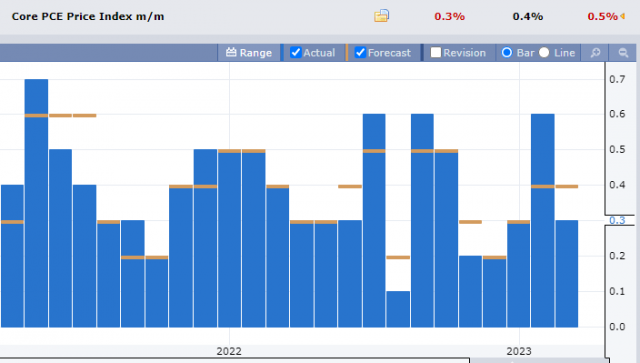

Here we are, folks. It’s the end of the week, the end of the month, and the end of the first quarter of 2023. As you well know, the big event today was the Core PCE Price Index, which is the Fed’s go-to guide in order to determine how the politburo will attempt to control the economy. Well, the results are out, and it’s a dream-come-true for the bulls. Not only did the number come in ice-cold (0.3% versus the 0.4% forecast) but the prior month’s number was revised DOWNWARD.

In spite of this, as I am typing these words, the /ES is up one-fifth of a single percent, and the /NQ is essentially unchanged. So I’m heartened by the fact that the bulls were served fantastic news on a silver platter, and the only thing on that silver platter is a dog turd.

I am further heartened (let’s face it, there’s a lot of heartening going on) by the MAIN story on MarketWatch. Right at the top, front and center, is this story.

The article features Tom Lee, who preens and minces his away throughout the article declaring why a new bull market started last October and how completely screwed the bears are.

He giggles and blushes at how Michael Burry has retreated from his own bearish stance, although I think Tom went too far when he scowled at the report and called me “that little bitch” (OK, I made that part up, but still, it would have been awesome).

In any case, having Tom Lee cooing about a scrumptious new bull market is all I need to hear to embolden my spirit. Maybe he and I can go antique-shopping and get our hair done when it’s all over.

Naturally, though, the knee-jerk reaction to the cool CPE was upward. But, honestly, it turned out to be kind of a non-event.

As I enter the trading day, I have 23 bearish positions and 20% cash. My dream scenario – – that is to say, the absolutely best case scenario for 2023 for the bears – – is below. I suspect global thermonuclear warfare would be required for the /ES to bang its way down to 3200 at some point, but again, this is my fantasy, so I get to draw it.