I’m afraid I might have some bad news for the bears and, frankly, I’m not that surprised, because things have been absolutely glorious for a few days now, and “a few days” is about the lifespan of happiness for the bearish set.

What I am referring to is what I call the Fed Spread, which is probably a misleading and inaccurate term, but it’s my shorthand way of saying “The calculation of a bunch of Federal Reserve data that comes out every Thursday afternoon and does a good job predicting the S&P two weeks into the future.” See, it just comes out easier my way.

Over the past few days, a major bank has failed pretty much every single day (Silicon Valley Bank, then Signature, then First Republic, then Credit Suisse………you get the idea) and, naturally, the central bankers of the world did the only thing they know how to do, which is to throw literally trillions of dollars at the problem.

I read about the stealth $2 trillion (yes TRILLION) program that the Fed has put together for banks over the past few days, and I was bracing myself for this to start getting reflected in the hard data. At this point, the reverse repo is barely changed.

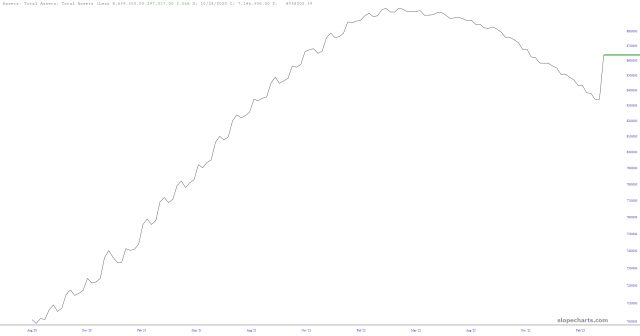

The balance sheet shows a massive move, however.

And the real eye-popped for me was the “Assets Held” data. As you can plainly see, the Fed was slowly, every so slowly, drip, drip, dripping their bond portfolio onto the world in a glacially-paced act of quantitative tightening (take note how much more swiftly they ACQUIRED the stuff).

See that out-of-the-blue sharp spike? Yeah, that’s not good. Not good at all. QT has come to a screeching halt, and we’re back into fuckin’ QE land, BIG TIME.

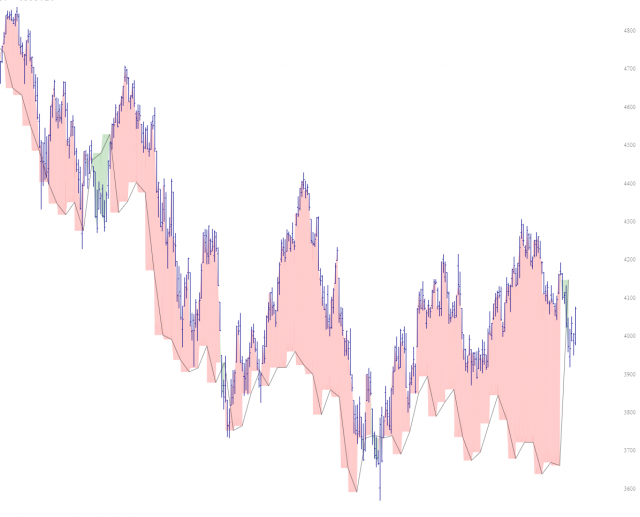

Smash it all together, and you get a MASSIVE move upward – – about 500 points on the S&P! – – on this chart.

Thus, the gargantuan spread that my fellow bears and I were drooling all over just a week ago has vanished instantly, and indeed there’s a small GREEN tint there now (indicating the market is, my God forgive me, somewhat undervalued at these levels).

In recent weeks, some of my readers have scoffed that this Fed Spread has outlived its usefulness (after all, the giant spread hasn’t resolved for many weeks), and all I gotta say is…………I sure HOPE you’re right, because these charts are terrifying.

For the record, my own portfolio positioning:

- I moved from 0% cash (yesterday morning) to 33% cash at end-of-day Thursday, so I’m not nearly as exposed;

- I also successfully played with FIRE over the past week by making profits on all my short-term trades, which mercifully I have none of anymore;

- Indeed, I have ONE and only ONE position that expires sooner than June 16, and that is IWM puts for April, which has 36 days left. The point being my hand-wringing about stuff expiring in a matter of hours is a thing of the past.

- I have 20 bearish equity positions – – some of which I lightened up on Thursday – – with options ranging from June 2023 to January 2024.

Long story short, I moved quite “risk off” on Thursday, and if the market interprets the above data as strongly bullish, I’ll probably have done myself a favor.