As we approach the end of 2023, I sense that it’s the upside-down version of the end of 2022. Back then, it was universally agreed there would be a recession and that equities were a disaster. These days, folks looking at 2024 universally agree that it’s going to be all about rate cuts and daily lifetime highs in equities. Sentiment is absolutely euphoric, and I’ve got to say, looking at these major index charts (which are either at lifetime highs or poised to achieve them), I wonder if they’re right.

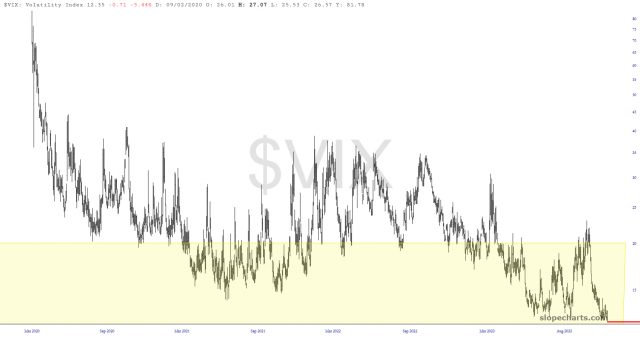

Yet it is a market truism that there is nothing the market delights more in than proving as many people wrong as possible. Given the fact that the VIX has been suffocated almost to death, and we could easily see an 11-handle on this poor beast in a matter of days, something tells me 2024 is going to be absolutely nothing like people are more assuredly anticipating.

Finally, I would note that, when viewed through the lens of valuation measured by gold, or money supply, the long-term picture of the stock market is really pretty awful, in spite of superficial perceptions.