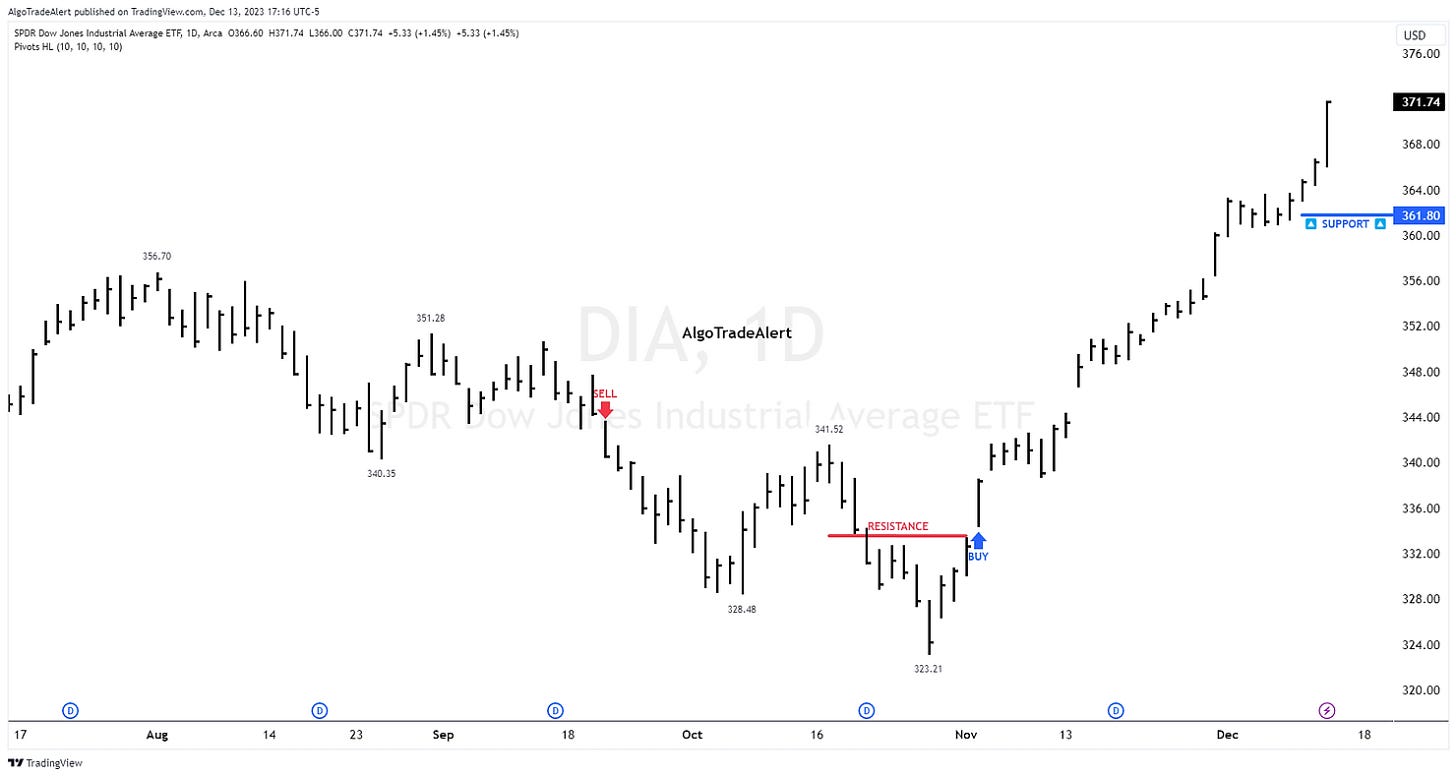

While the stock market cheered, surging 1.5% and pushing the Dow to a fresh record high, concerns linger about the potential for long-term trouble.

Hawks On Hold, Doves Take Flight:

The Fed’s recent messaging has been a symphony of hawkish rhetoric, emphasizing their commitment to taming inflation through aggressive rate hikes. However, this week’s tone was markedly different. Powell downplayed the prospect of future cuts, acknowledging market expectations but stopping short of outright confirming them. This dovish shift, even subtle, has fueled speculation of a potential pause or even reversal in the rate-hiking cycle.

Soft Landing With A Risky Rally:

The market’s euphoric reaction is understandable. Lower rates are generally seen as positive for equities, and the prospect of a soft landing – where the Fed manages to curb inflation without triggering a recession – is music to investors’ ears. However, the optimism might be misplaced.

Looser Financial Conditions, Rising Risks:

While the Fed’s rhetoric softened, their actions haven’t mirrored the dovish shift. Quantitative tightening (QT), the process of shrinking the Fed’s balance sheet, remains in place, effectively draining liquidity from the financial system. This tightening, coupled with ongoing geopolitical uncertainties and potential corporate earnings headwinds, could create a combustible cocktail for the market later down the line. The FOMC statement shows no substantial changes in language, maintaining rates between 5.25 to 5.5 since the last increase in summer.

Food for Thought for Investors:

- Don’t get swept away by the euphoria: Remember, central banks are notoriously opaque, and their actions often contradict their words. Stay cautious and don’t over-leverage based on dovish whispers.

- Maintain a diversified portfolio: A well-diversified portfolio across asset classes and sectors can help weather potential storms.

- Keep an eye on the data: These are lagging indicators but focus on key economic indicators like inflation, employment, and consumer spending to gauge the true health of the economy.

Powell’s dovish pivot has undoubtedly altered the market landscape, but it’s crucial not to get caught up in the immediate euphoria. Remember, the road to a soft landing is fraught with uncertainties, and navigating this volatile environment requires a cautious and well-informed approach.

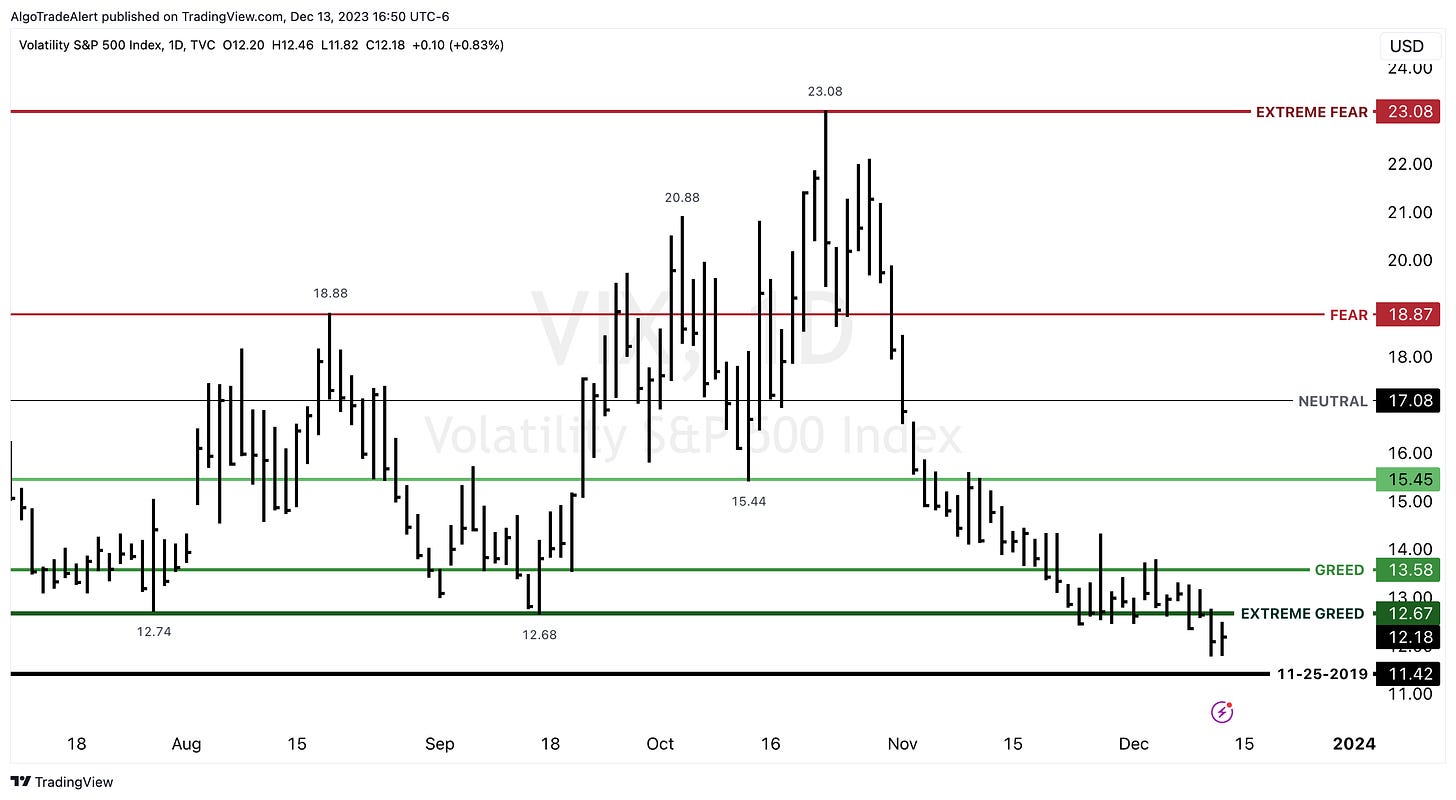

Away from stocks WTI crude advanced towards $70 thanks in part to a larger-than-expected drawdown of weekly crude inventories, gold ripped 2.2% to $2,026 an ounce and the VIX stayed just above 12.

A lower dollar will create more inflation and higher asset prices will do the same.