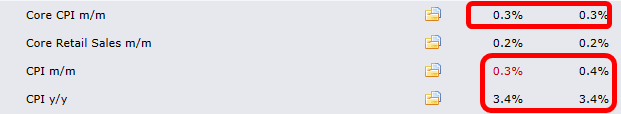

The latest completely-made-up and watered-down inflation numbers came out, and they are, surprise, surprise, exactly as anticipated. We’ve become like China in that respect: a number is “supposed” to be certain level (let’s say: Real Inflation divided by 10) and then, oh mah garsh, the official number is the same.

Of course, yesterday, when the PPI was WAY higher than it was supposed to be, the market still went up, but today, with the number exactly the same, the market…….went up. It’s kind of heads, bulls win, tails, bears lose.

At the same time, besides the watched-by-everyone CPI numbers, the actual economic data continues to suck out loud. The Empire State Manufacturing Index was much worse than expectations, and as you can plainly ass from the chart below, this thing has gone from robust and solid to a complete poo-fest.

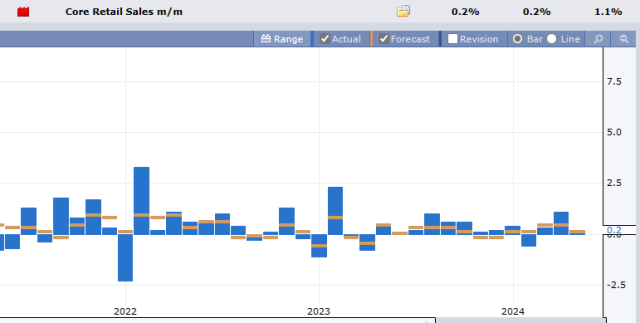

Retail, too, could be very politely described as “tepid.”

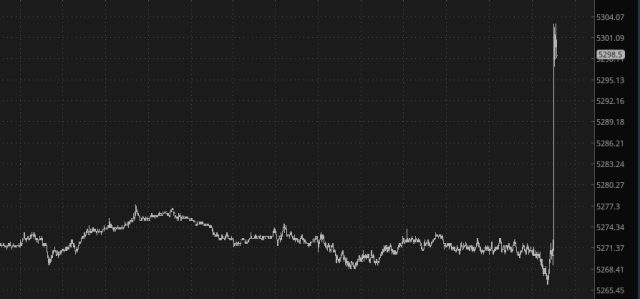

But none of this matters. Once the fake inflation numbers came in at expectations, people fell all over themselves to buy up insanely-inflated stocks at even higher prices, pushing most indexes into new lifetime high territory. It truly is late 2020/early 2021 all over again.

Bonds are also strong, with the /ZB cutting into its right triangle.

As I’m typing these words, 45 minutes before the open, the market isn’t exactly melting up: the /ES and /NQ are both up about half a percentage point. Still, it feels like about a decade since we’ve had any market weakness that lasted more than twelve seconds or so.

I guess Election Years are too important for an administration not to prop up, right? I look forward to the wheels falling off this nonsense a few milliseconds after the polls close on November 5th.