From Not Your Advisor Substack

Preface: There are many implications like taxes and estate planning so consult your FIA and accountant. I am not your advisor!

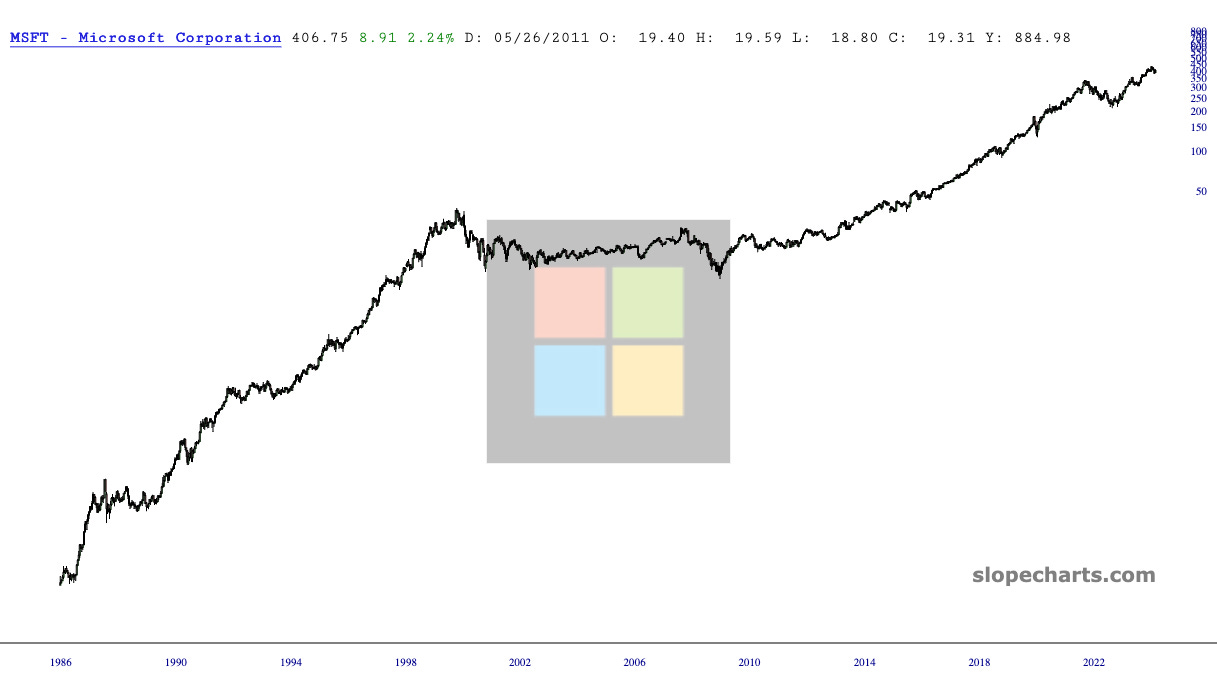

If you are 21 years old, 28, even early 30s, you have time to repair a wrecked portfolio that lived through 1987, 2008, and the pandemic crash. They all recovered and soared past their respective peak to trough.

But not everyone has that time. So this is a cautionary tale for those who are at a point in life where time feels like it’s getting faster, healthcare costs are rising with age, and timing is important.

Below are examples when Diamond Hands would have been crushing.

Hopefully you have been diversifying your wealth across different asset classes like real estate that is paid off, bonds, businesses that generate cashflow, and stocks ie, 401k, Roth IRA and your regular portfolio.

Even better, you may have started out young with an 80/20 portfolio of stocks to other asset classes and slowly migrated to 60/40 then 50/50 then 20/80 by the time you are retiring.

However many have sunk all their chips at the stock market table. Where transacting is easy, alcohol is free and the marketing to participants is rampant.

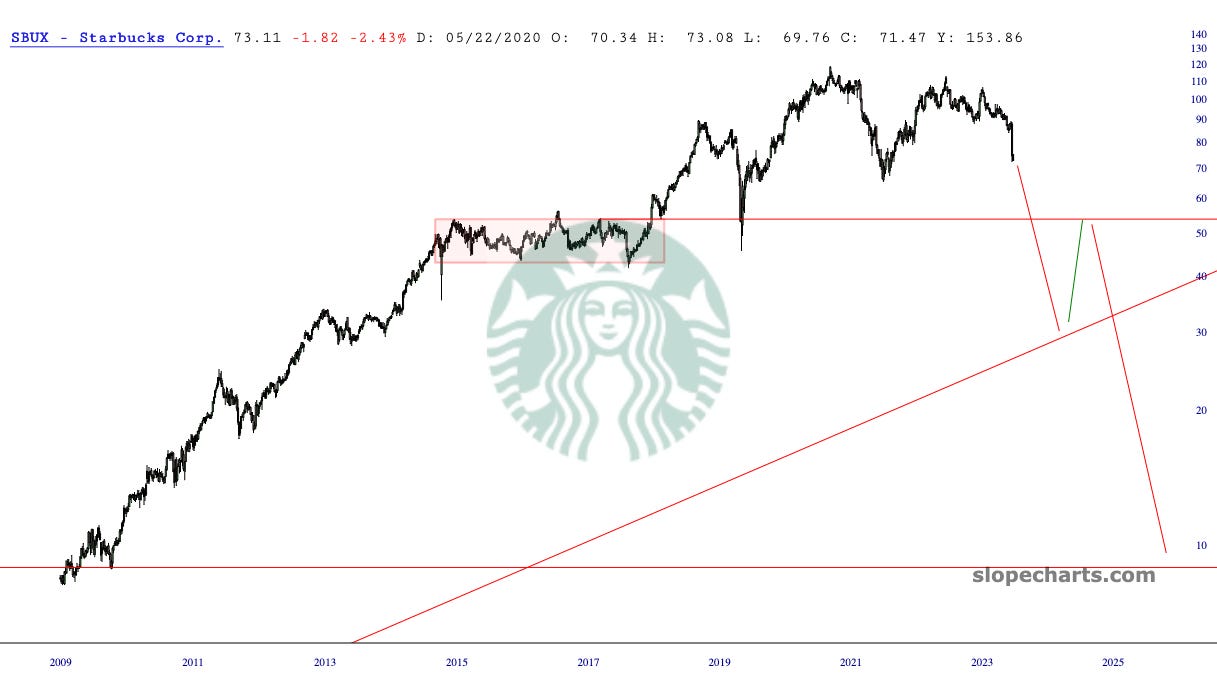

Let’s play the “What if” game. What if I retired in either of the the red zones.

This first chart below is Starbucks lifetime chart (Exhibit 1).

(Exhibit 1)

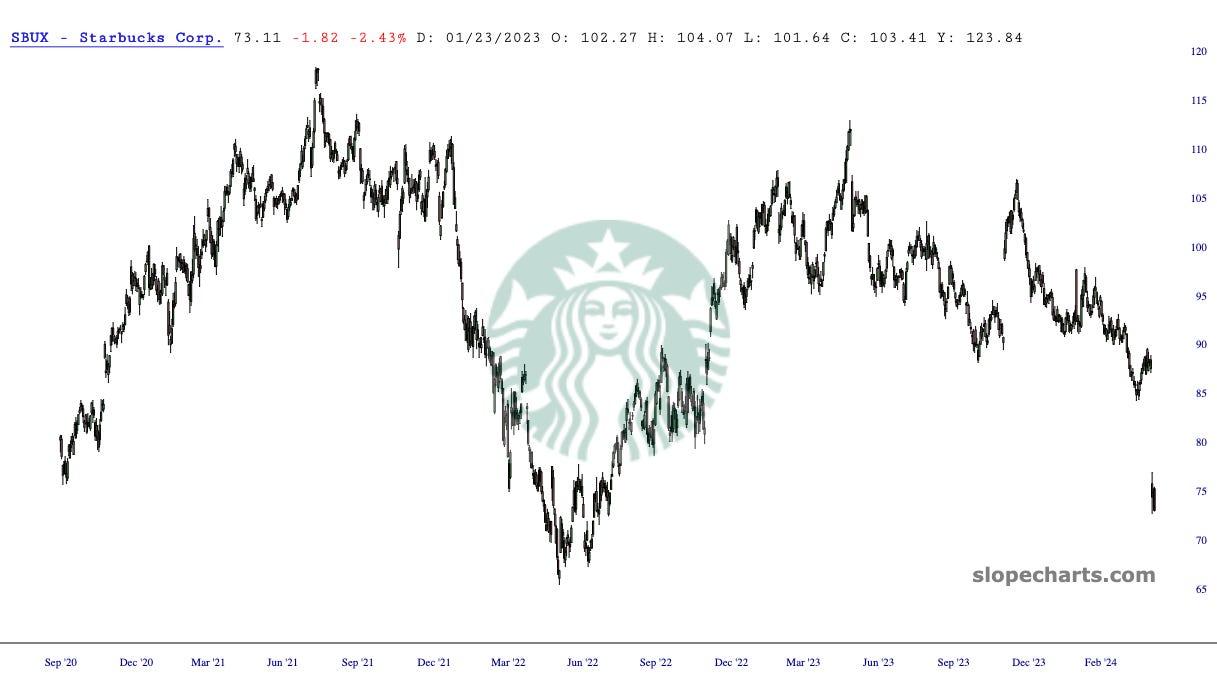

Let’s imagine you bottom ticked and bought the bottom in 2005 (Exhibit 2). Soon you were entering retirement and elated to see SBUX rise from $9 to $15 and never booked any gains. then to see it fall to $3. You would have to wait over 4 yrs from purchase or 2 yrs from going red from the purchase to recover. Not too bad in grand scheme of things but a lot of anxiety and stress. Maybe two years of cruise tours around the world to get your mind off of it.

(Exhibit 2)

But if you look at the lifetime chart, what if you are entering retirement and are overweight SBUX today and we experience something like 2008 or a longer period of stagflation? Let’s imagine you bought it perfectly coming out of the balance area in October 2018, see it rise. Diamond Hands hold during the pandemic lockdown. See it rise, then fall like right now. What if you held through a potentially a bigger selloff as imagined below in (Exhibit 3). That can’t happen! Cmon man. Don’t be a permabear. When has this happened before besides Starbucks?!

(Exhibit 3)

Current Linear chart of Starbucks today

Eh you are insane you say. Stocks only go up up you say! If you sell now you will miss the best rally ever your advisor says. And you and they are probably right in the long term. It’ is all about the timing when you need the money. Let’s look at a few more shall we? Or should I stop?

Let’s look back at Intel, the former Nvidia of yesterday. If you bought the breakout late in the bull, you could have been waiting fourteen years to break even! What if you bought correctly at the backtest of this trendline in Feb 2023 where it had a proper structure to go long? Great, you are still up, barely. But what if it falls and we have another episode like the last and you have to wait another 14 years?

Yeh but that is Intel. That was a very unique situation you say?!

And another: Cisco. Switching to Linear graph scale to show the severity of the pump and dumps. If you arguably bought the breakout at $25 in 1998 people would have been calling you the wonder trader of the time at bbq’s and wall st banquets prior to 2001. But once the market popped, and you were still holding, you would have waited 16 years to break even.

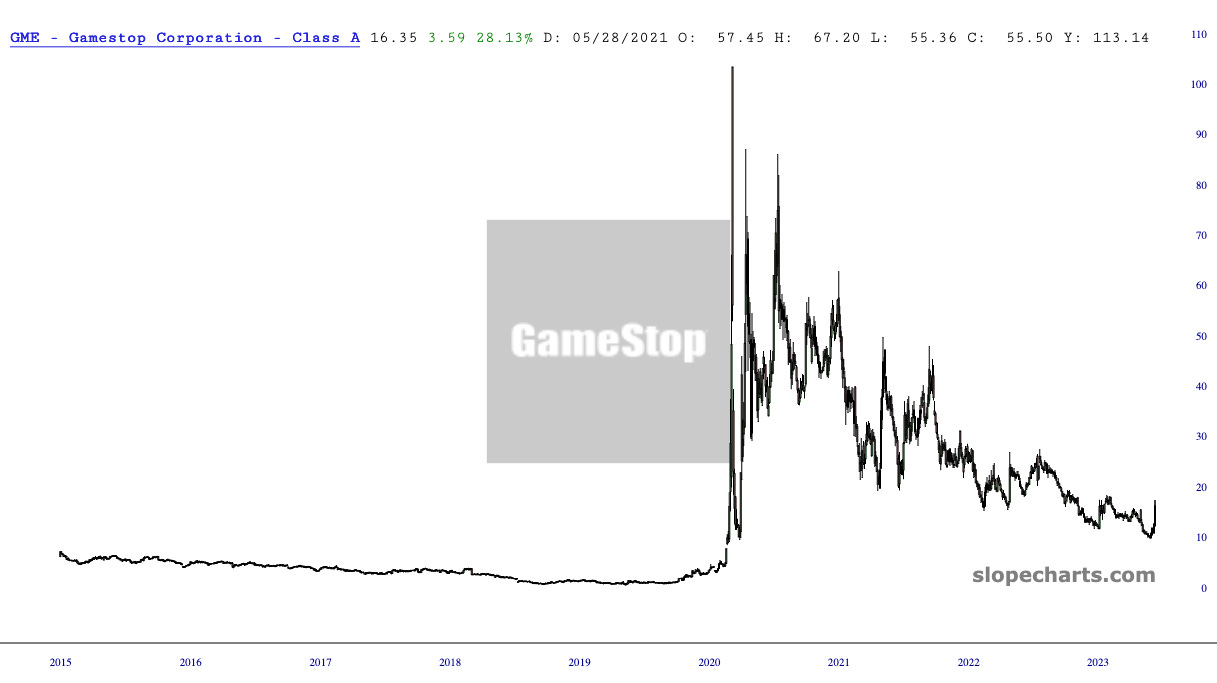

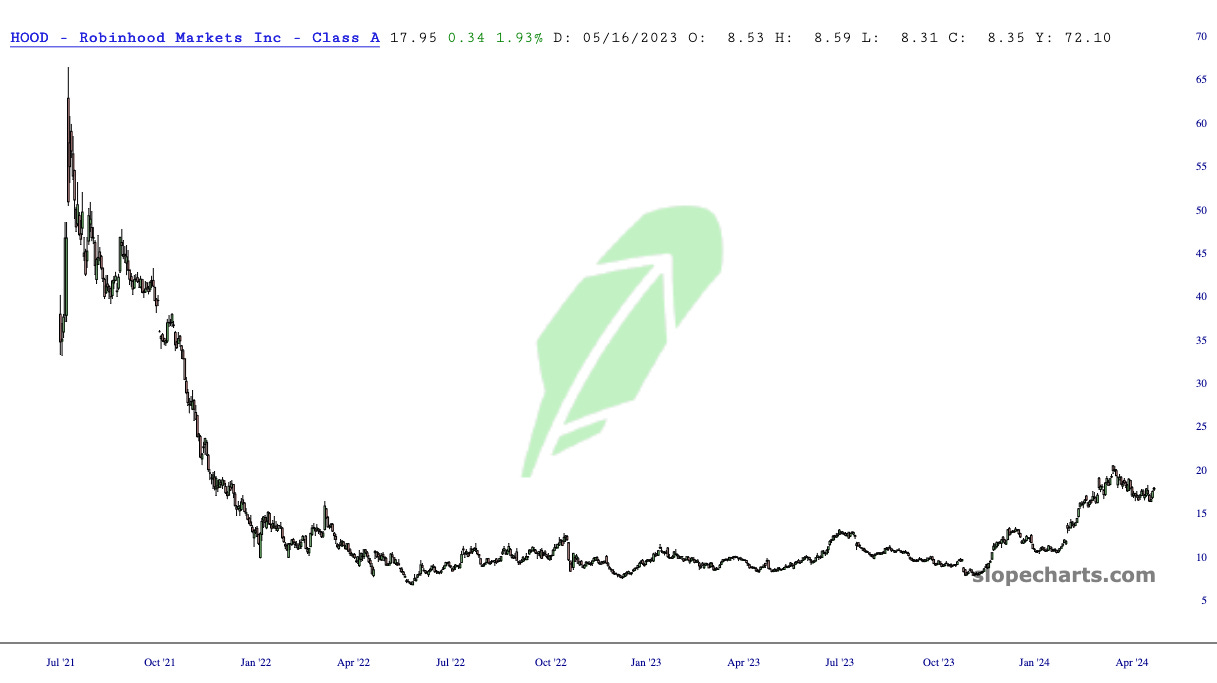

Let’s show some more rapid fire:

Conclusion

Not going through those draw downs would have been a very good option. Timing the market is hard work. Filled with FOMO emotions and self blaming pits of anxiety. Being nervous is a sign of being unprepared and without a plan, not position size.

But never selling and passively buying regardless of price location is very dangerous…Diamond Hands is a Sell Side construct. Even Warren Buffett sells.

#YOLO trading is a by product of a hopeless generation drowning in the wealth gap.

Maybe I am a worry wart. A cynical fool that will miss the last 20% of this rally?

I don’t think so as I have gone long on stocks like META, APP, and many others as my paid subscribers know.

But I will 100% miss the majority of the next big draw down!

I will end this with a hopeful thought. Hey maybe all will end well like the below. Good luck! Sincerely!