GameStop Goes Parabolic

“Roaring Kitty”, as the meme stock investor Keith Gill calls himself, returned to X after an absence of three years last month, and posted a few memes, with no specific stock commentary. On the basis of that alone, GameStop Corp. (GME) shares spiked from $17.46 on May 10th, to $55.69 on May 14th, before giving back those gains. That was his first GME pump this year.

Last weekend, Gill returned to Reddit, posting a screen shot, purportedly of his account, showing a $116 million position in GameStop, and 120,000 call options on it. As a result the stock spiked over 64% in early trading on Monday. That was his second GME pump.

Finally, on Thursday, Gill promised to do a YouTube livestream about the stock on Friday. On that bit of non-news, the stock spiked 47.45% on the day, before climbing another 31.62% after hours. GameStop opened at $31.28 on Thursday morning, and ended the after hours session at $61.27. We were bullish when this stock was below $20, but we are definitely bearish here.

We Were Bullish Below $20

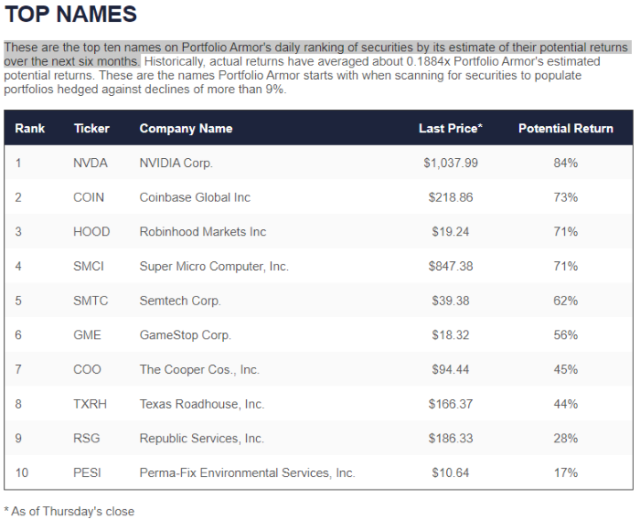

As regular readers know, each day the market is open, our system ranks every security with options traded on it in the U.S. by its potential return over the next six months. Since we started our Substack in December of 2022, our weekly top ten names have returned 22.73% over the next six months, on average, versus 12.63% for the SPDR S&P 500 Trust (SPY). On May 23rd, GameStop hit our top ten when it was trading at $18.32.

Screen capture via Portfolio Armor on 5/23/2024

We tried to place a bullish options trade the next day, but didn’t get a fill.

We Were Neutral At $30

With GameStop trading around $30 earlier this week, we took a neutral approach to it, betting on volatility after its earnings next week. Specifically, we placed two split-strike butterflies, one bullish, and one bearish, where we would make money, on net, as long as the stock moved strongly up or down after its earnings.

Click on the cat to go to the post.

We Are Bearish At $60

Frankly, we were bearish at $40 too. At Thursday’s 4pm closing price of $46.55, GME was trading at a forward P/E of 4,609, according to Chartmill data. Above $60, its valuation is even more ludicrous. We can’t imagine anything Roaring Kitty can say in Friday’s livestream that will make GameStop worth more, and we don’t expect the company’s management to pull a rabbit of a hat during next week’s earnings release either. GameStop missed on both top and bottom lines last quarter, and the only positive thing we can think of that has come out of Roaring Kitty’s current pump is that the company was able to issue a secondary offering enabling it to shore up its balance sheet (albeit, at the cost of dilution of shareholders.

How We’re Betting Against It

We don’t want to short a meme stock, and assume the uncapped risk that entails. At the same time, buying puts on it will be prohibitively expensive. So our approach here is to sell in-the-money credit call spreads. We have orders open for two of them now, here’s one: a vertical spread expiring on June 14th, buying the $48 strike GME call and selling the $38 strike call for a net credit of $6. The max gain on that one, if it fills, will be $600 per contract, the max loss will be $400 per contract, and the break even will be with GME at $44.

Essentially, our bet is that GME will be trading in the mid-30s or lower by June 14th, as we’re assuming nothing will happen when it releases earnings on June 11th to support its current valuation and the air will come out of the GME bubble again. If that happens, and GME is below $38 on June 14th, the credit call spread above will expire worthless, and we’ll keep that $600 per contract. If it closes over $44, we’ll lose some money, and in the worst case scenario, if it closes over $48, we’ll lose $400 per contract. One nice thing about this approach is that your risk is strictly defined and limited.

Friday Morning Update

Well, it looks like we were right to be bearish on GME over $60, but we’ll probably have to adjust our trades now.

A Bullish Trade On Deck

We also have a bullish trade teed up on another stock, a mining company that hit our top ten names on Thursday. If you’d like a heads up when we place that one, feel free to subscribe to our trading Substack/occasional email list below.

If you’d like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).