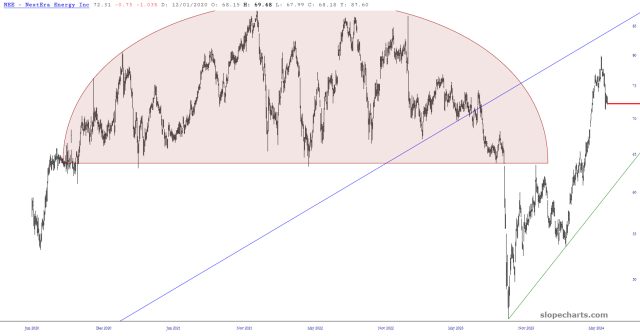

One of the most bizarre sideshows of the entire AI obsession has been the notion that utility companies are AI plays. The canard wrecked what had been one of the most fantastic setups I had ever witnessed, which was NextEra Energy (NEE), a stock I wrote about probably a dozen times. When everyone accepted the “fact” that the most boring sector in the world was the equivalent of NVDA, it was all over.

NEE has weakened over the past couple of weeks, and this evening it’s really taking it on the chin as the company decided to get while the getting is good and is selling billions of dollars of stock in exchange for nice, fresh cash. Thus, NEE’s weakness is getting even weaker.

I established my XLU as my largest position a couple of weeks ago, and I’ve been happily riding it lower. Even today, a day in which the market ROARED to more lifetime highs based on absolutely nothing but momentum, good old XLU continued to weaken. It should be weaker still tomorrow (that would be Juneteenth Eve, as we call it here around the Knight household).

My one lingering concern about my XLU puts has been the question as to whether the Dow Utility Index itself would find major support at the Fibonacci line. It actually cracked it a little Monday, and I firmly suspect it’ll answer this question in the favor of the bears first thing Tuesday morning.