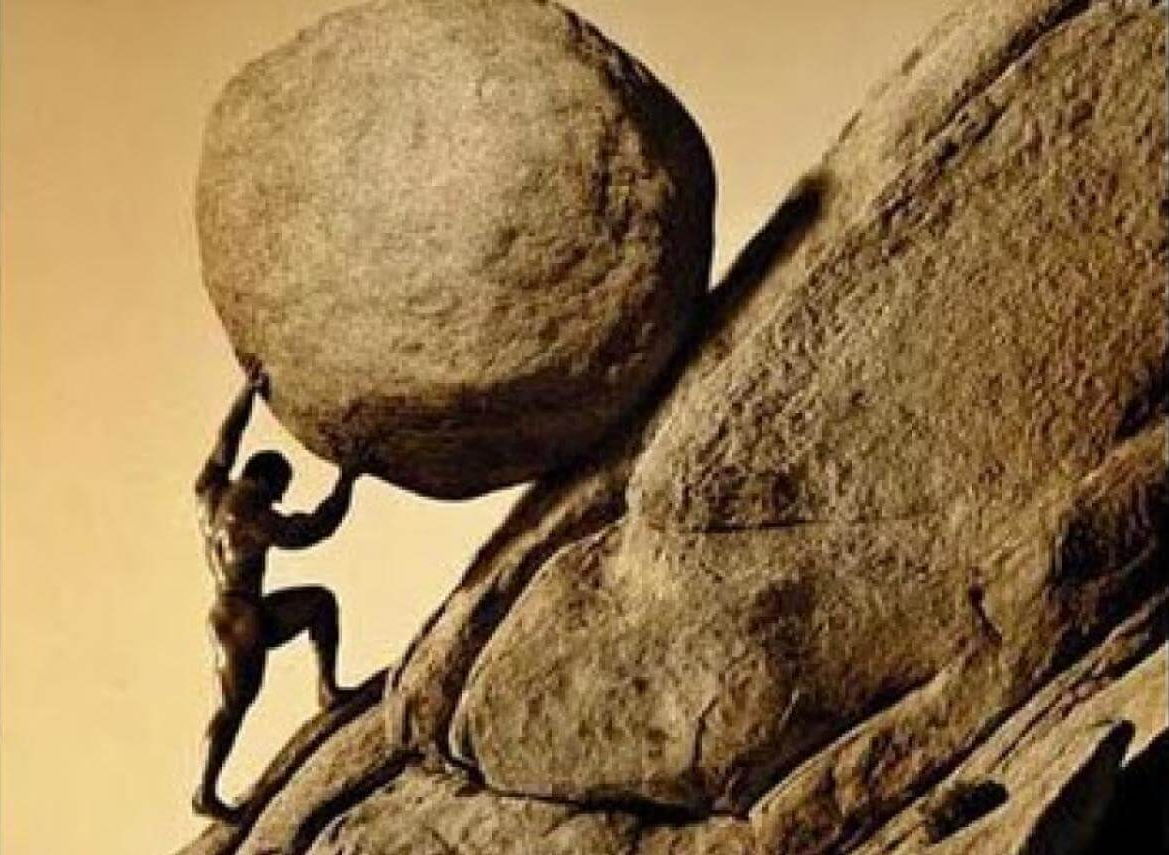

Most of you are acquainted with the ancient Greek tale of Sisyphus, the “most cunning of men” who was condemned by the gods to roll a boulder up a hill for all eternity, only to see it roll back to the bottom each time. This myth, for obvious reasons, makes its way into the trading culture with some frequency.

Some weeks ago, I made an important decision to add an element to my trading life that I’ve never had before. The plan is simple: once my account reaches a pre-determined level, I am going to cash out of a fixed percentage of my entire portfolio, shoving that cash directly into my pocket, and not deposit anything else into the brokerage account.

Specifically, each time I reach a 25% profit in my account, I am withdrawing one-fifth of the entire account in the form of cash and “paying myself”, as the saying goes, and not allowing a single penny of those funds to get back into the account again. If I can manage to do this four times, my account will be purely “house money,” and perhaps I’ll take on a more aggressive strategy. As it is, however, I am sticking by the requirement to make four “forced withdrawals” to make damn sure I pay the person that is doing all this hard work. Namely, me.

I think you can appreciate the psychological advantages of this scheme. The main disadvantage, of course, is that no matter what I think of the market’s prospects at any given time, I am deliberately going to eliminate 20% of my entire account and foreclose any prospect of further profits for that portion. That denial of potential profits doesn’t bug me, however, because all too often, just when things are looking fantastic, they instead fall apart (like, oh, let’s say the June 16th-August 16th hellscape).

Anyway, that’s my plan, and I’m going to stick to it. It’s an interesting approach to risk management, and psychologically well-being, and obviously I hope it turns out all right (specifically, that I get to make those four withdrawals).

/what-is-withdrawal-how-long-does-it-last-63036-Final-c41a8e50c2b54216b93f7d4a74a073bd.png)