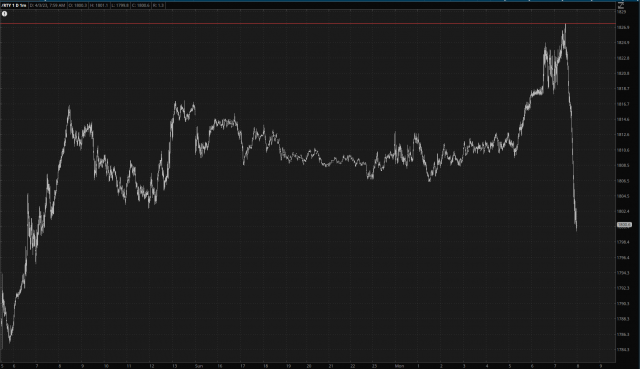

Well, it couldn’t happen to a nicer group of guys. The swaggering, swine-like bulls came into this week, certain that S&P 500 was heading to 6,000 without a downtick in sight, and things short-circuited. Here are the small cap futures, which capture the sudden shift succinctly:

The longer-term chart illustrates the mass of overhead supply which continues to act as the ally to the bears.

When I think of bulls, I imagine then in the year 1940 trying to decide if they’ll join the Axis or the Allied powers. They always choose the Axis. And why? You can hear them now: “Don’t cha wanna be on the winning side? BE FLEXIBLE!” Why not be with the winners, eh? It doesn’t matter how evil they are, as long as the outcome is positive for you.

That’s called moral relativism, and I refuse to play.

However, that’s the bullish mindset. No morals. No ethics. No scruples. Just short-sighted allegiance to whomever seems to be large and in charge at the time. That’s about as far as their limited cranial capacity can carry them. It’s always why these pigs are totally dependent upon BAILOUTS AND HANDOUTS.

SBF was a bull.

Elizabeth Holmes was a bull.

Adam Neumann was a bull.

You get the picture.

Sadly, even I am not immune to their poisonous thinking, so I am unable to stay steadfast during times like this morning. As is so often the case, I’d have been better off doing absolutely nothing at all. Instead, I dumped my QQQ puts at a modest profit (which puts are soaring in value as I am typing these words) and I panicked out of COP and HES at big losses. I will at least say in my defense that I ADDED to my surviving energy positions, since I think today top-ticks energy stocks.

So, the literal and proverbial bottom line:

- I am down to 19% cash

- The market is falling absolutely to pieces before our eyes

- This market remains absolutely treacherous and is one of the hardest markets to trade in any of our lifetimes

- Bulls suck