What Trading Signals Are Strongest Now

As we wrote last week (Why Trade Stocks?), we’ve been using ten different factors, or signals to decide which earnings trades to take, and at the end of each week, we track the performance of all of them to see what’s working best, on both the bullish and bearish sides.

Based on those signals we placed seven trades last week, five of which were winners. Below we’ll recap the signals we’re using, and then show you which ones are working best now.

Our Ten Factors For Evaluating Earnings Trades

We use these ten factors for evaluating earnings trades:

- LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

- Portfolio Armor’s gauge of options market sentiment.

- Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

- Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

- Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

- Zacks Ranking. A number from 1 to 5 with 1 representing their 5% most bullish stocks, 2 representing their next 20%, 3 the middle 50%, and so on.

- The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

- Recent insider transactions.

- RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

- Short Interest.

Quantifying Bullishness And Bearishness

To compare apples to apples, we assign simple numeric rankings to each factor. For most of them:

- Extremely Bullish (rare) = 3

- Very Bullish = 2

- Bullish =1

- Neutral = 0

- Bearish = -1

- Very Bearish = -2

- Extremely Bearish (rare) = 3

Social Data

For social data earnings scores, Likefolio considers +20 and higher to be bullish, and anything -20 or lower (more negative) to be bearish. For our purposes, we consider anything between +20 and +39 to be bullish (1), and anything from +40 to +59 to be very bullish (2). A rare score of 60 or higher we give a 3 to.

Options Market Sentiment

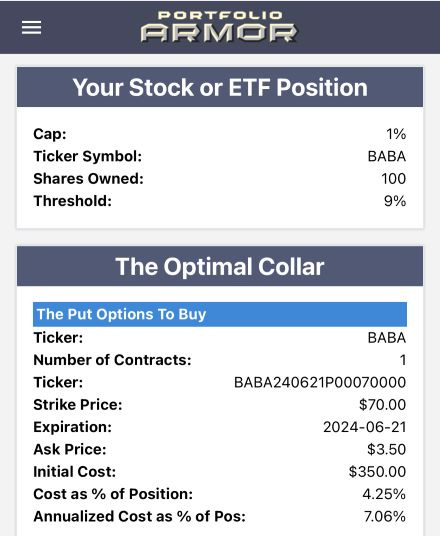

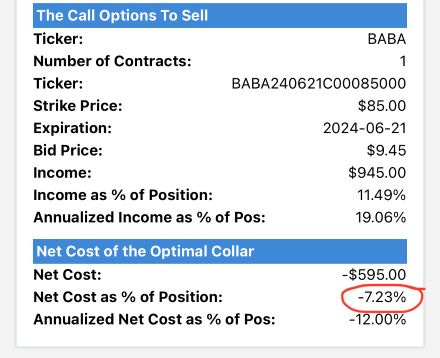

For options market sentiment, we’re looking at the cost of hedging a stock against a >9% decline over our default time to expiration (roughly six months) with an optimal collar capped at 1%.

Screen captures via Portfolio Armor.

We run a daily ranking of securities with positive price momentum sorted by the cost of hedging them as above; currently the hedging cost of the top ten names on that ranking goes from -7% to -5.8% of position value. Since BABA above had a hedging cost of -7.23% last eek, we gave it our highest bullish ranking for options sentiment, a 3. Stocks with hedging costs between -5.8% and -7% would get a 2; between -3% and -5.7% a 1; between 0% and -2.9% a 0 (neutral); between 0% and 8.9% a -1, and anything above 9% a -2, for very bearish.

Set-up and Valuation Ratings

These two Chartmill ratings are on a scale of 0-10. We give scores of 0-2 a -2 (very bearish), scores from 3-4 a -1, 5 a 0 (neutral), 6-7 a +1, and 8-10 a +2.

Piotroski F-Score

Scores from 0-2 get a -2, scores from 3-4 get a -1, 5 gets a 0, 6-7 gets a +1, and 8-9 gets a +2.

Zacks Earnings ESP

A single digit negative score, say -3.21%, gets a -1; a double digit negative score gets a -2, a 0% score gets a 0, and a single digit positive score gets a +1, and a double digit positive score gets a +2. Rare, extreme scores in either direction, get -3 or +3.

Zacks Ranking

For this one, the raw number (1 through 5) is the same number we use.

Recent Insider Transactions

Most of these get a 0, for neutral, as large companies in particular often have frequent insider selling, and if that’s part of regularly scheduled sales, it’s not clearly bearish. Notable net insider buying or selling shortly before earnings gets a +1 or a -1, respectively, with higher numbers for rare, extreme situations (like a stock where every open market insider transaction over the last year was a buy).

RSI

Anything between 30 and 70 gets a 0, for neutral. Between 29 and 25 (oversold) gets a 1, and under 25 gets a 2. We haven’t seen any over 70, but those would get a -1, and maybe a -2 if over 80 (over bought).

Short Interest

Short interest of less than 10% gets a 0, for neutral; between 10% and 19% gets a 1; between 20% and 29% a 2, and above 30% a 3.

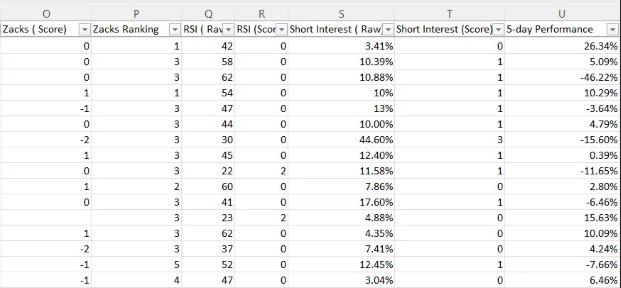

Tracking Performance of These Factors

For each stock we evaluate each week (not just the ones we place trades on), we enter the data above in a spreadsheet, and at the end of the week, we record each stock’s 5-day return.

Then we compare the average 5-day performance of all the stocks with the average 5-day performance of the ones that had social data scores of +2, +1, etc.

The Strongest Signals Now

After crunching the latest data, these are the strongest signals now, as measured by the average 5-day return of stocks exhibiting these signals prior to earnings. By way of comparison, the average 5-day return of all the stocks in our sample was 4.75% as last week.

A Couple Of Counterintuitive Results

On the bearish side, the returns for ostensibly extremely bullish short interest (+3) and very bullish valuation (+2) are both negative. With respect to valuation, it’s likely that the stocks are cheap for reason, and that reason is related to concerns about their future earnings. With respect to short interest, recall that a +3 refers to short interest of 30% or more. What’s interesting here is that if short interest +2 (from 20% to 29%) is actually still a bullish signal: the average 5-day return of stocks with that level of short interest has been +9.85%. It seems that beyond a certain level, stocks with extremely high short interest are more likely to continue to fall than bounce back. But we’ll keep running these numbers after every week of earnings season and see if that remains true.

Putting This Into Practice

We’ll be using this data to analyze earnings trades this week. If you’d like a heads up when we place our trades based on this, feel free to subscribe to our trading Substack/occasional email list below.

If You Want To Stay In Touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on Twitter here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).