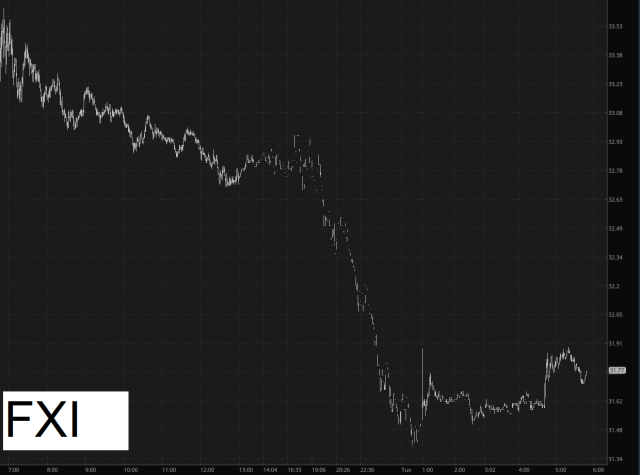

For all the pearl-clutching and teeth-gnashing last week about how amazing yet-another-bailout from China would be, it hasn’t amounted to jack squat. There was feverish talk about how the Chinese Communist Dictatorship’s Ministry of Finance (sounds straight out of 1984, doesn’t it?) was going to hold a big press conference on Saturday and Monday morning. They did, declaring how “ultra-long-term bonds” (that’ll never be paid off, I’m quite sure) in the TRILLIANS of yuan were being issued. In response, the market hasn’t done dick.

Indeed, for the past week, we’ve been burning off the laughable attempts that China, which hasn’t invented anything new since gunpowder, is going to gain the top spot in the world’s economy by issuing more debt than anyone else. Their government makes the U.S. look positively prudent, which is no mean feat, and there’s PLENTY of downside left.

My favorite Chinese victory remains PDD, about which I wrote precisely one week ago.

Obliquely related to China is crude oil, which is my highest concentration of shorts. The data from China, massaged as goosed as it is, still shows a crumbling economy, and this fact isn’t lost on wiser markets such as crude oil. We’re already in a global recession. Next year, the data will finally ‘fess up to it.