I was taking a lot of flak last week for posting broken support trendlines on ES and NQ and suggesting (gasp) that this POMO driven market might ever retrace even to provide a bigger dip to buy. Here we are this morning and the opening gaps down on ES and NQ are looking likely to be substantial. Will it last? Perhaps, and I think the obvious retracement targets are at a lower level than I'm seeing this morning. We'll see.

First up this morning is the ES 60min chart, where I'm seeing an obvious target at the 1310 level, for a wedge turned channel support trendline and potential HS pattern neckline:

The target is less clear on NQ, but I'm liking 2388 as another potential HS pattern neckline, and NQ has reversed in the pre-market (so far) at the obvious short term resistance area, which is the broken wedge turned channel support trendline:

Oil's been spiking heavily on the news that unrest in the Middle East may topple some incompetent kleptocrat dictators in the oil rich countries. I've been having a close look at the oil chart and the last low has established a rising channel with the next target just over 98. There is some longer term resistance at 96.6:

I've been watching USDJPY (inverted yen) in recent days and I'm wondering if the Yen is likely to make one last outing as a flight to safety trade before it resumes the march to likely oblivion. It looks promising:

I saw an amusing headline from those sly wits at Bloomberg this morning and it read ' Stocks in developed countries are rising the most since 1998 while emerging markets slump, a sign the U.S. is returning to its role as the engine of world growth aided by a recovery in Europe.' What is it exactly that the US is doing to be the engine of world growth at the moment? Simple, the US is the world's leading manufacturer of money, and is exporting it worldwide along with its inseparable companion, asset inflation. Fun while it lasts, but it can only last until the first serious revolt in the bond markets, and after that the US will have to consider alternative ways of boosting growth with an empty wallet and deflating assets.

I haven't called a top here, and I'm not planning to, as the end of QE2 is still months away and it's hard to see how we can see a major top until it ends. Nonetheless I think this bull market is unlike other bull markets in a number of important ways, mainly that it's stronger and faster than any bull market since WWII, and that it is the only bull market supported by huge deficit spending and money printing since WWII. These characteristics are obviously linked and considering the prospects for this bull market without considering the future of quantitative easing is a nonsense.

What's my point? I was reading the other day that no bull market since WWII had more than one correction over 10% before it ended, and as the retracement last year was 17%, that ruled out a retracement larger than 10% this year. For the obvious reasons that's not really applicable to the bull market we're trading here, and if, like QE1 last year, QE2 finishes with the Fed talking about an exit strategy for quantitative easing and without announcing QE3, then a major retracement this year is very much on the cards, and if there is no QE3, the bull market may well finish with QE2.

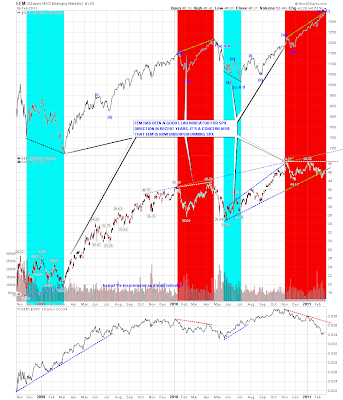

I've been watching the emerging markets too, as they have often worked well as a lead indicator for SPX in the past. EEM starting to underperform SPX was one of the indicators for the equities top last year and we're seeing something similar now. That amusing Bloomberg headline could have been posted in March 2010 as well looking at this chart. The bottom section of the chart is EEM:SPX and that definitely looks interesting here:

Why's that interesting now? Well I posted yesterday that the main resistance trendline on SPX had either broken or overthrown, and I'm watching carefully to see how far this retracement now goes. On the SPX daily chart my targets are in the 1315 area for the lower trendline of a possible rising channel since July, 1295 area for the lower trendline of the rising wedge on SPX, and if that last target breaks with conviction the technical wedge target would be 1040 SPX, with the overthrow ruling out the possibility that the wedge would become a rising channel. I'm not expecting to see that, but with what the EEM chart is showing it's worth bearing in mind:

The buy the dippers should be out in force today, and we might bounce from the open, but if not I have 1310 ES and 2338 NQ as the likely reversal targets and I'll be watching those.