I was tidying up some things in my home office today, and I noticed a couple of binders that I hadn’t looked at in years. They were labeled “Tim’s Trading Tome” volumes one and two. In them were hundreds of pages and charts I had collected in late 2008, 2009, and 2010, Early 2009 of course, was the bottom of the market, and we began a multi-hundred-percent climb (in the case of some stocks, multi-thousand-percent) climb.

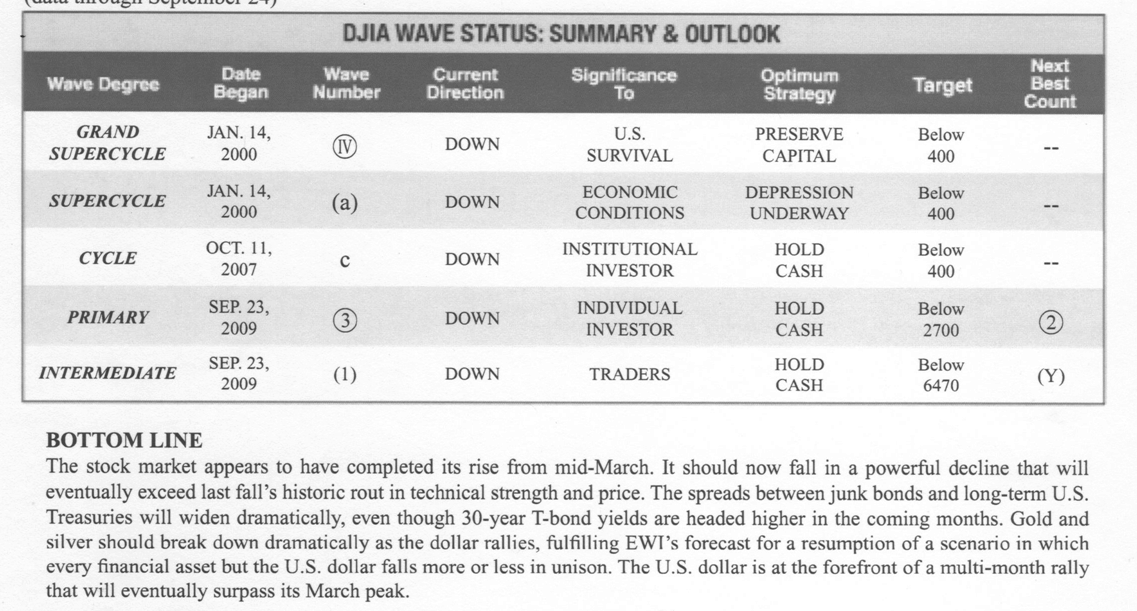

Naturally, though, on the heels of the financial crisis, there were plenty of popular publications that were saying it was the start of something much bigger. Here’s a snippet from one we all know:

You will note that all five “cycles’ were DOWN. The timing of this was September 2009. I think we can all agree that the cycles were, in fact, not DOWN at that time, in retrospect………..nor are we anywhere close to hitting the target price of 400 on the Dow Industrials.

On top of this, there was plenty of mocking of the MSM (Main Stream Media, for those of you not accustomed to wearing tin foil fats) who were foolishly predicting strength in the market for years – years, I tell you! – to come. Here the same publication laughs at a projection of the Dow getting back to 10,000…….

The cold fact of the matter is that dumb, simple-minded, mainstream publications like USA Today were 100% correct, whereas expensive, niche, arcane financial publications were, in some cases, hilariously and laughably wrong………..for years. Strangely, the same publication mentioned above turned bullish about a year ago.

I’m the first to admit I’ve been as guilty as anyone of beating the bearish drum and making crazy projections about how low the market will go. I’ve dismissed the idea of any huge drop anytime soon, because the central bankers are simply not going to allow it. Looking at these two binders was really eye-opening, just to see how crazy the bears were in 2009 at what was clearly one of the greatest buying opportunities of the century.