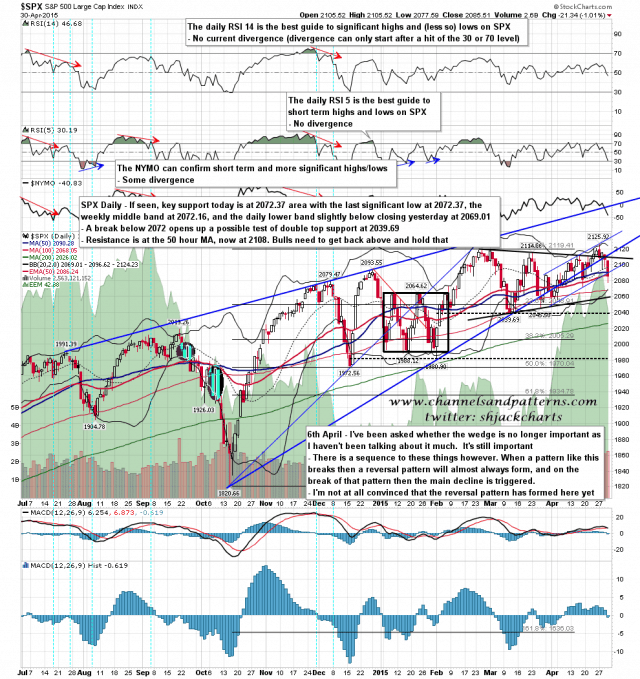

SPX broke the short term rising channel yesterday as well as the daily middle band. I’m not seeing any strong reason to think that yesterday’s low won’t be retested and if so there is strong support at the last significant low and the weekly middle band, both at 2072. A break and particularly a close below would open up a test of double top support at 2039. Overhead resistance is at the daily middle band at 2096 and bulls really need to get back over and hold over the 50 hour MA at 2108. SPX daily chart:

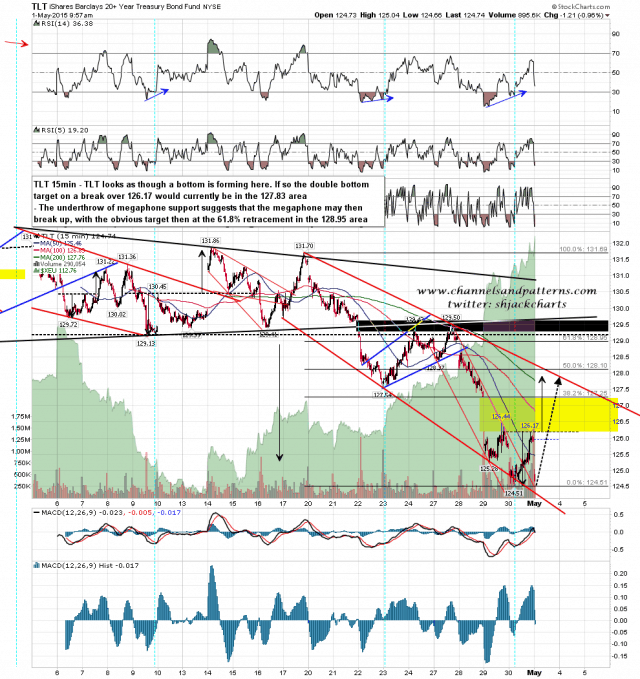

There is a very nice setup for a bounce here on TLT with a possible double bottom targeting the 128 area on a break over 126.13. If seen then the underthrow of megaphone support yesterday suggest that the megaphone will then break up, with an obvious target in the 128.95 area at the 61.8% fib. It’s worth remembering though that these megaphones break down 30% of the time, and on a break below 124 this rally setup would be gone. TLT 60min chart:

We haven’t seen any major support breaks yet and I am still looking for a spring high to be made in either the 2140 or 2170 SPX area. A break below 2072 would make that less likely so bulls need to hold that area.