Yesterday was a dispiriting day for the bear side. Not only was there no follow through to Friday's drop, which wasn't unexpected as a bounce was likely, but there were bullish breaks up on copper, EURUSD, GBPUSD and silver. The first three of those all made new highs and that weakens considerably any argument that we will see any bearish follow-through this week.

That we are still seeing some promising topping patterns is still the case though. On ES we seem to have a broadening top forming, and I'm looking with some concern at the top trendline, as to reach it we would have to break strong trendline resistance in the 1313 – 17 area. I've marked in two internal trendlines that look likely to provide resistance this week:

IWM has broken the rising wedge and is forming another broadening top. The broken trendline has already provided resistance and should be significant when reached again:

On EURUSD yet another promising reversal setup folded yesterday as EURUSD crawled up the underside of the (third recent) broken support trendline to make another short term high. It would be easy to get the impression that EURUSD is just making fun of the short side now:

I don't know how much immediate upside is left in copper now, though oil (/cl) looks likely to make 93.4, possibly after some helpful riots in Egypt today. Silver has a nice looking long setup here, having broken up from the declining channel yesterday and consolidated around the broken trendline overnight. A promising looking rising channel has formed that looks ready to take silver higher. At the time of writing at least silver is just above the lower trendline of that channel:

Dow Theory expects the Dow and The Transports index to make new highs together. If they don't you have a non-confirmation until the lagging index makes a new high as well. You often see such non-confirmations before significant highs. The Transports index ($TRAN) is lagging very badly at the moment and has not confirmed the latest highs on the Dow. It is a long way from a new high, though as I was looking at the chart I doodled in a small falling wedge that might get it there:

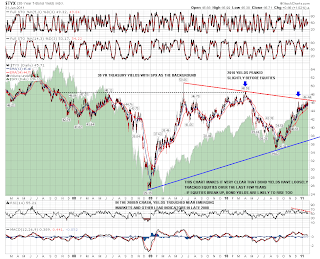

Probably the most thought-provoking chart I looked at this morning was the 30 year treasury yields daily chart. Long bonds look ready for a bounce that might or might not drag down equities with them. There's serious negative divergence on the daily RSI and yields have hit the resistance trendline on this chart, which I last posted in September I think when I was arguing that the likely effect to QE2 on bonds would be negative (the bond yields chart is the inverse of the bonds chart). Obviously that was right, but I don't see the juice there at the moment to break that declining resistance trendline without at least a pullback first:

I'm leaning towards us seeing a slow grind up on equities this week. I'm hoping we'll see some decent trendlines form along the way.