An interesting trading day today, to be sure! The market went rocketing higher, but the damage to my all-short portfolio was never very bad (I came into the day 70% committed in 88 different short positions). As the market started weakening, I pushed into the green, and I stayed there all the way through the close. In spite of the NDX being up and the S&P being virtually unchanged, I enjoyed about a 0.36% gain. I’m not going to argue with that.

Over the course of the day, I goosed up my exposure to about 75%. In my options account, I took profits in August EEM and IWM puts, and I committed to stick to September-or-later options (I don’t like to screw around with stuff that’s going to expire in the next couple of months). Overall I was pleased with the day (and, for no particular reason, I had the movie Rogue Trader playing on my big Macintosh screen……….and was amused to discover that Nick Leeson has a Twitter account).

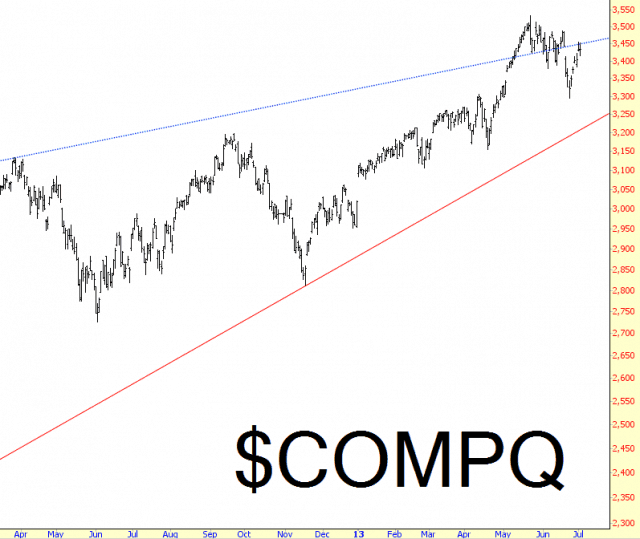

My view on the market hasn’t changed (in case you didn’t divine that from the fact I’m still entirely short). The NASDAQ is pooping out at its resistance trendline.

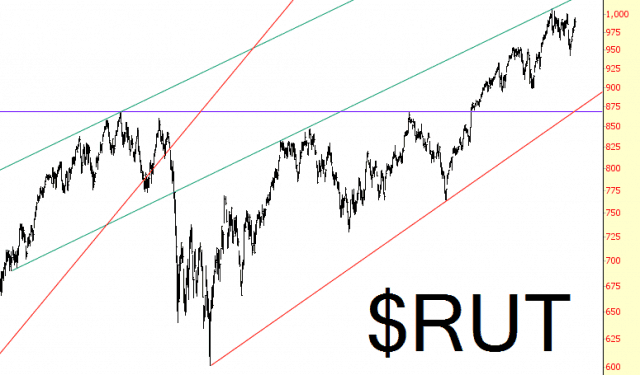

And the recent series of lower lows/lower highs on the Russell is still quite intact, with a target of about 900, which is nearly 10% lower from present levels. Wouldn’t that be a nice drop?

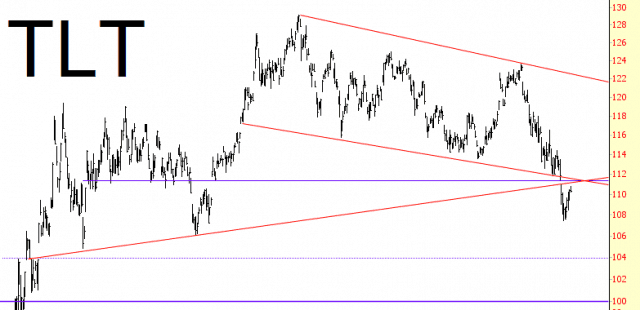

My favorite chart right now is of bonds, by way of the TLT. My view is that we’ve got a gorgeous confluence of trendlines which constitute important resistance. I think next week we are going to plunge away from these levels, both in stocks and in equities. Hand-in-hand, they will look into the abyss and leap.