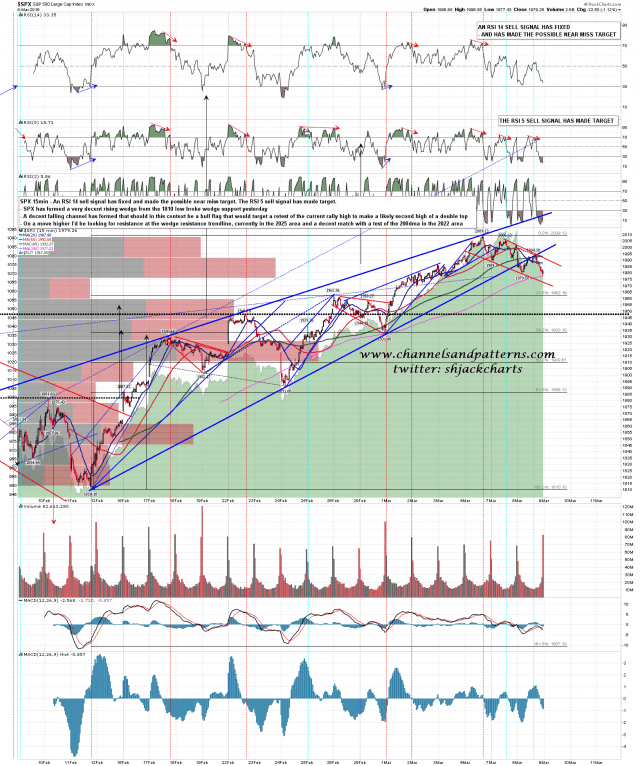

The rising wedge on SPX broke down yesterday and SPX should now be in the topping process, though there is still room above for a possible test of the 200dma, currently in the 2022 area. There is a falling channel from the high that is a likely bear flag, and when that flag breaks up on SPX I am expecting at least a retest of the current rally high. Flag resistance is currently in the 1993 area. SPX 15min chart:

On ES the rising wedge has not yet broken down at the time of writing, with rising support and the weekly pivot (at 1976.3) tested together at yesterday’s low at 1976. The next obvious targets within the wedge are a retest of the high or wedge resistance currently in the 2018 area. Flag resistance on ES is currently in the 2000 area. ES Mar 60min chart:

Main support today is still the weekly pivot on ES at 1976.30 (approx 1977/8 SPX). Assuming that support area holds I’m looking for a retest of the current rally highs in the next couple of days. Main resistance today is the 1993/4 ES (approx 1994/5 SPX) that has held every attempt to break over it since Monday night, and that resistance needs to break to open up a retest of the rally high. Stan and I are looking for this next high to be the last on this rally. We were looking at that in detail in the public Chart Chat on Sunday, and you can see the recording of that here.