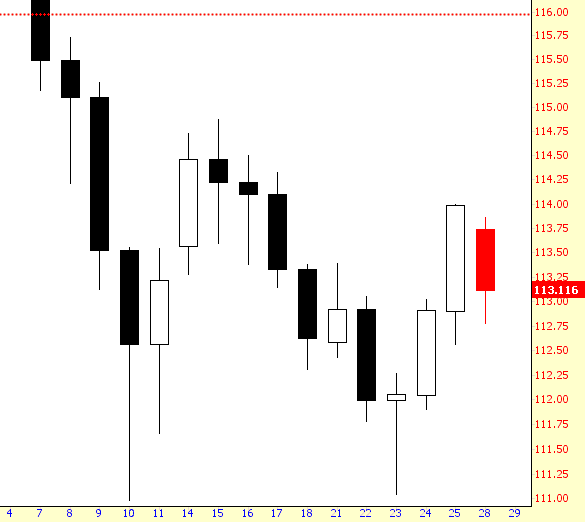

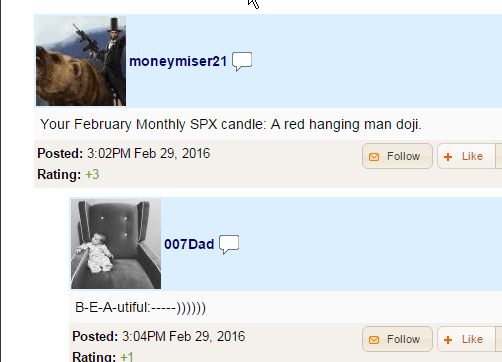

A comment today after the close caught my eye:

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Federal Reserve states that its goal is to promote employment and economic growth while regulating inflation. As if it is as simple as pulling levers, tweaking a few knobs and dialing up just the right amount of inflation per unit of economic growth. The hubris and ego involved here is incredible.

For the last several years global macro dynamics had allowed the Fed to operate in a highly inflationary manner, while inflation’s effects discretely festered in areas of the ‘services’ economy (like healthcare, regulatory entities, real estate, leisure and hospitality and certain food items). It became clear to me that despite commodities driving down the raw costs of doing business, inflation’s effects had embedded in the services economy when my trash hauler informed of a rate increase due to regulations in the services chain, despite the crash in fuel costs. That is just one little example. Larger examples infect the entire economy.

Early last week we saw the USD/CAD consolidate over key support levels which was leaving us with quite a few options on the table as to the short-term pattern. At that time I noted that I was viewing the 1.3652 support level as a key signal level that would help indicate if we were indeed going to see a C wave higher back into the 1.4000 range or if we would simply continue to move directly into the lower bypassing the C wave back into those higher levels. Well, it took a few tests of this support level, but finally after the third test of this 1.3652 level we saw a sharp move lower. So with this break the big question is now what is in store in the weeks ahead?

On the larger time-frames it is clear that the top that we saw in January at the 1.4696 level was a significant larger degree top. This high hit the 338.2 extension of the initial wave off of the 2011 low almost to the penny. While the 338.2 extension is a less common extension, the fact that it came so close to hitting that fib on such a large degree does make me take notice. This is a much more common Fibonacci extension level that we would expect to see during a third wave and not a C wave. See all the charts with wave counts here.

Well, another morning, another disappointment. When I hit the sack last night, the ES down down double digits, and the Chinese stock market was in another freefall. Before I fired up my iPad, I facetiously asked myself what I would think if the ES was green. Well, I didn’t have to wait long to find out, since everything had already reversed.

What’s really eye-opening is that even though the USD/JPY is down pretty firmly