News is an odd thing nowadays. On the one hand NFP was a big beat, so the economy seems to be in better shape than everyone thought, so a recession is less likely -> BUY!. However that means that interest rates are now much more likely to increase again this year and that the ZIRP era is more likely to be drawing to a close -> SELL!. We’ll see how that develops in RTH.

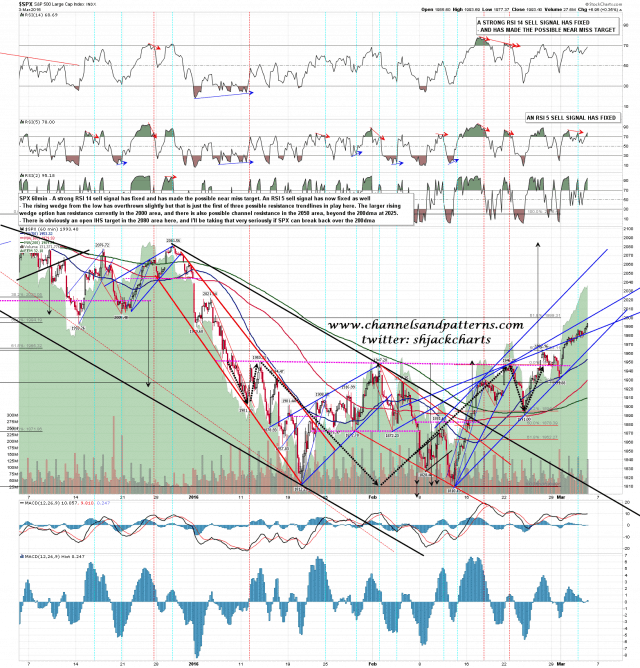

In the short term SPX looks likely to open in the 1995-2000 area that I was looking at yesterday morning (DONE AT 1996) and that may hold. If so then I’d be looking for at least a strong retracement, and possibly new lows for 2016. There is a lot of negative divergence here and this is the obvious area to fail. SPX 60min chart:

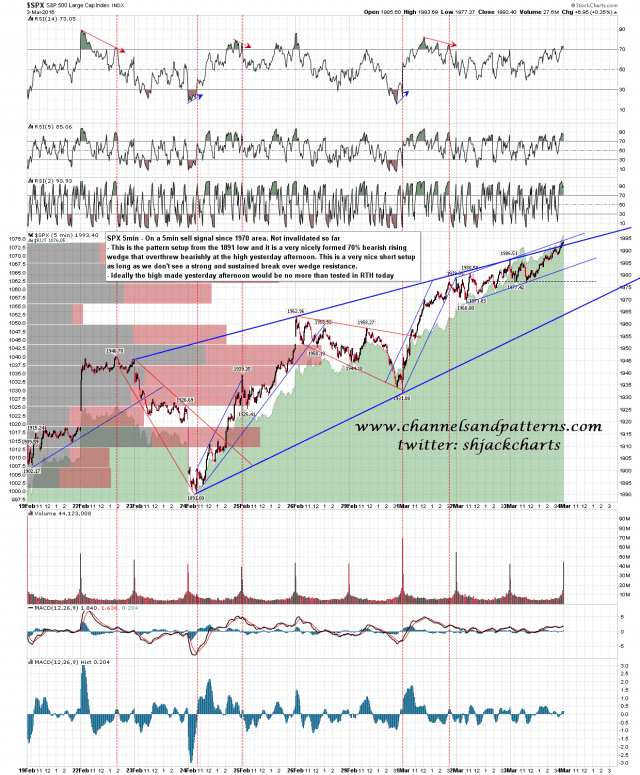

The pattern setup from the 1891 low is also a rising wedge that is looking very toppy here. The obvious lean on the pattern setup here is bearish. SPX 5min chart:

One concern I had yesterday morning was that ES rising wedge support had not yet been hit. That target was hit on the NFP spike so that is no longer an open target. A 60min sell signal fixed on ES yesterday. ES 60min chart:

Are we going to see a rally high here? Well the pattern setup leans strongly bearish and we are in my preferred rally high area. The odds of a bullish break up towards the IHS target at 2082 will increase on any move over this resistance area in my view, though there is still very strong resistance above that could hold.

Stan and I are doing our once per month free to all Chart Chat webinar at theartofchart.net on Sunday and that should be very interesting. If you are interested at all in the higher probability paths for prices on equities, forex, precious metals, bonds etc over the next few weeks and months then you should seriously think about attending. If you have no interest in these things and read my work simply because you just love high quality TA, then there will be plenty of that there too, so I’d suggest attending anyway. You can sign up for that on this page here. Everyone have a great weekend 🙂