When markets are cheap, such as in 1982 or early 2009, the task of bulls is straightforward: find good, solid, growing companies, but your money in, and leave it alone. Simple. Straightforward. Very, very profitable.

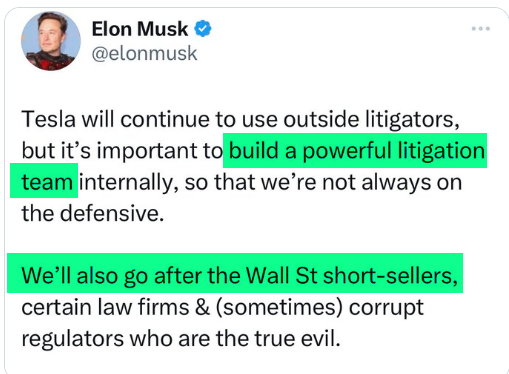

When markets are an overinflated joke like, oh, say, right this second, this isn’t how it goes. The task of bulls is to beg for handouts, plead for fake 5-star analyst reports, and, when necessary, blame anyone but themselves for the troubles of their company. This tweet showed up yesterday, and I could hardly believe my eyes:

It dawned on me – – – and, yes, I can be quite slow – – – that March 13th was the precise sort of “get the hell out of everything NOW” days that we need to watch out for. I’m not referring specifically to the Billionaire Bankers Bailout that that ancient old vermin Yellen and that evil anti-Christ Powell trotted out on Sunday (of all days) March 12th. In other words, it isn’t just the trillions of dollars they ejaculated all over the backs of the bankers that is important. It’s the fact that they panicked at all.

You see, the kind of market that will work best for us is kind of like what we had in 2022: one in which things just erode, break down, fracture, and worsen little by little. Day by day. Week by week. You basically don’t want to wake up the occupants of the Eccles Building.

When something huge like Silicon Valley Bank and Signature Bank (and Credit Suisse and First Republic and on and on and on) explode, and the central bankers of the world all freak out and simultaneously “help out” their banking buddies, the markets aren’t trustworthy anymore. It takes at least a few weeks after the “help” has ceased for some semblance of sanity and tradability to return. (It has, happily, done so now, as I saw WeWork resumed its slide toward $0).

I was much too impatient. I must tell myself that the next time they pull a stunt like this (and there will be MANY stunts to come) I need to roll up my circus tent for a few weeks and wait for the insanity to blow over. We don’t want the Fed scared and helpful. We want them complacent so that, bless ’em, they’ll be kind enough to allow the market to ever-so-slowly do what it needs to do.

Have a good day, folks. Onward.