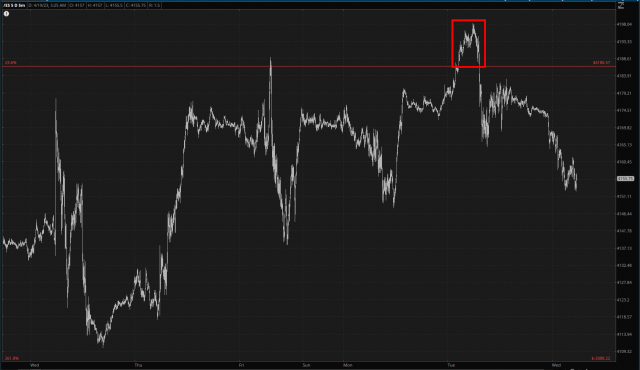

Good morning, everyone. It feels like ages since I’ve woken up, clicked on my screen, and said “Good” when I saw the quotes, but there we have it. After yesterday morning’s “all the bears are doomed now” post. some wiser Slopers recognized my despair as a compelling short signal. The burst above the Fibonacci, highlighted below, was short-lived, and we’ve been grinding lower since then.

In my defense, I did state in the post that the levels we were trading had been, since last August, reliable exhaustion points, but you never know when these things are going to cut higher. At the moment, however, we have painted the 4th instance of an exhaustion top, and Lord knows I’d love to see this thing slip, slide, and stumble for hundreds of points from here. It’s quite clear that those turds with teeth named Powell and Yellen hammered out a bottom with their Billionaire Bankers Bailout on March 13th, so perhaps the sugar rush from that latest criminal bailout has run its course. Bulls are pathetic and loathsome creatures, and they depend on endless government bailouts to save their worthless, empty-headed selves (which is why we’re $32 trillion in debt, incidentally).

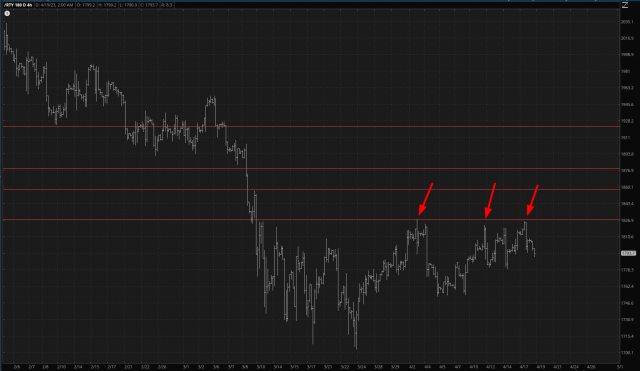

It’s kind of a shame, too, since I ditched on great put positions like TSLA (which is falling to pieces this morning and has earnings after the close today), but I’ve still got 24 bearish positions and only 3.7% cash. The small caps have also been cooperating, with their three-peat of this level as a failure point.

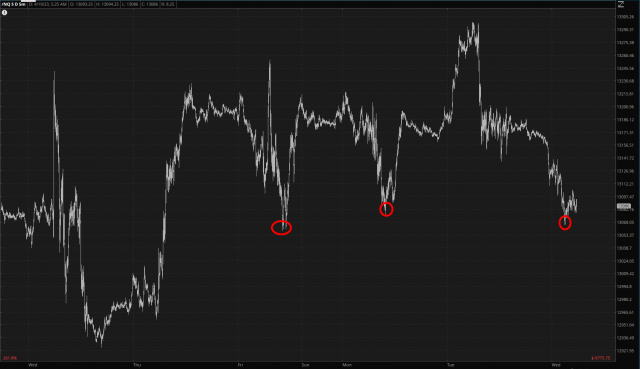

More progress has to be made, however, to break the spirit of the criminal element. Here we see the /NQ has been beaten down to a level that in recent days has served as a “gee whiz, what a bargain!” point for the smooth-brained. If we continue to erode, particularly since we’re at the beginning of what could be an exciting earnings season, I might load the account up with more cash and push into more positions. Let’s just agree that the VIX at 16 was pretty damned appealing for the ursine sort.

I’d like to tip my hat to our own Richard Cranium, who directed my gaze, once again, toward Zerohedge which has become so steadfastly perma-bullish in recent months that they make Investor’s Business Daily actually seemed level-headed. I have been despairing about this betrayal, but it finally got through my very thick skull what a good thing this is. I mean, fact the facts: these guys sprang into existence almost to the DAY that the market bottomed in early 2009, and they were my permabearish buddies from February 2009 (their birth) through the end of 2021.

These days, however, they have a decidedly different tone.

Of course, last year, when I very gently point out this change, I discovered I was banned from their comments section (which itself has always been kind of a mash-up between a national NRA convention and a Klan rally).

What I’m trying to say is that I was foolish to decry their change of heart. I celebrate and embrace it, for reasons that I hope should be obvious but simply took me a long, long time to understand. And if you STILL aren’t excited about the prospects of this week………