Good morning, everyone, and welcome to a shortened trading week. I won’t gripe about this three-day weekend as much, since I actually consider the holiday at hand to be legit, although I’ll still be grinding my teeth at the lengthy time away from the keyboard.

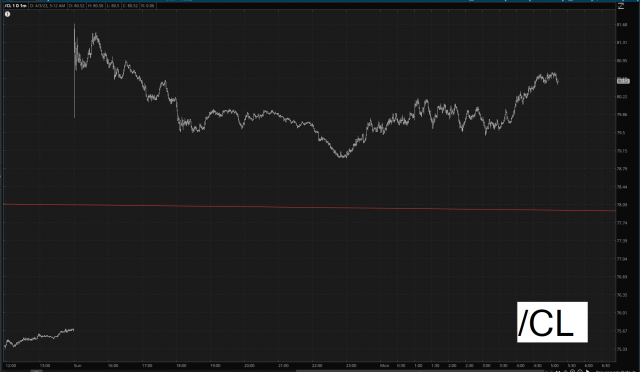

This day begins, of course, with oil, which is the big change from the last few weeks in which some bank disaster or another was the news of the day. This time, the global energy cartel has decided to poke its best customer in the eye, and although it’s off its highs from the initial spike, oil is still up about 6%.

What’s bad for your beleaguered host is that he’s got six different energy shorts, every one of which is sure to get torched at the opening bell. Now, to be clear, none of my options positions expire any sooner than 74 days from now, but I’m honestly not the sort to sit on a big loss and tough it out. It’s possible that I bail on every blessed one of these positions, since energy stocks are very strong pre-market.

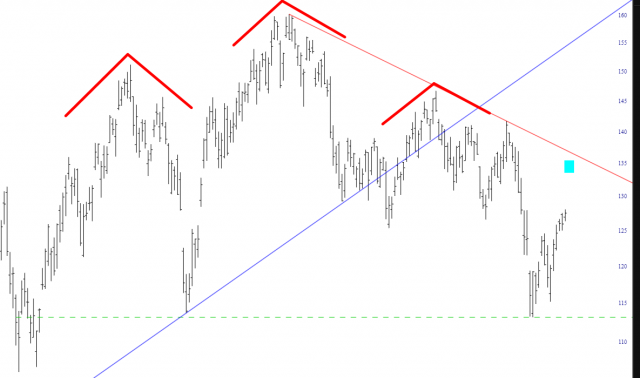

The real shame of it is that today is probably going to be a sensational time to get short energy stocks. The trading level for XOP right now is roughly where I’ve tinted below, which is an extremely attractive spot to go against the crowd.

Like I say, though, I’m going to take on some real damage getting out of these positions, and I won’t have the stomach to try them again just yet. Know, at least, that this big push higher in oil is probably a golden opportunity for those who have been itching to get short energy companies. My timing, sadly, was quite unfortunate with this surprise announcement.

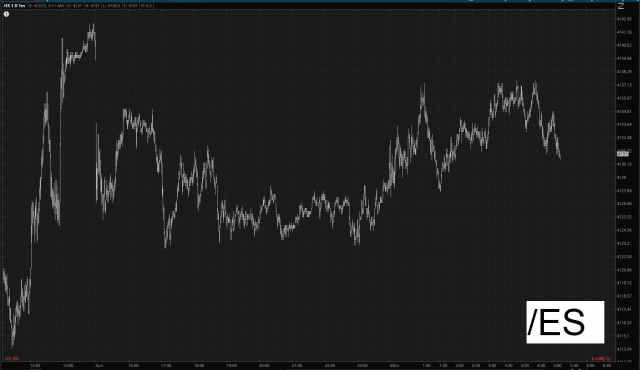

Stock futures remain, for the moment, in the red, although they have toyed with going green at some points during the overnight session (/RTY managed to get positive now and then). Crude oil’s strength absolutely dwarfs any weakness in the stock market, however.

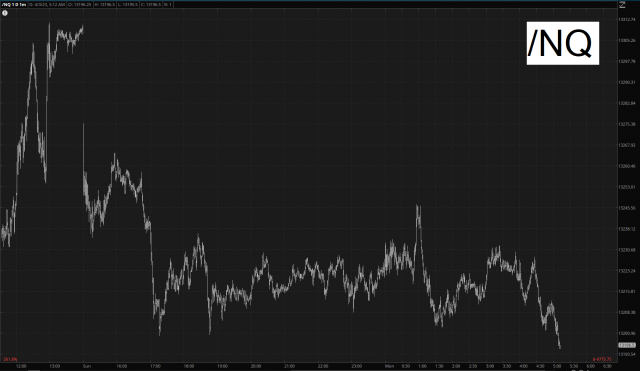

One tiny silver lining for me is that, late on Friday, I took on a single aggressive position in QQQ puts which expire today (yep, we’re back in 0DTE land), and since the tech stocks are the weakest this morning, the profits from this lunatic trade will take SOME of the sting out of the aforementioned energy short losses.

So, in sum:

- I’ve got 20 equity short positions, 6 of which are energy related and are thus at risk of being blown to bits, every last Man Jack of them;

- I’ve got a single ETF trade (0DTE QQQ $323 puts);

- I presently have 23% cash, which is a figure that will rise swiftly as I get out of these energy shorts;

- I’ll take a few big steps backward and assess the market afresh once I address this crude oil situation

Have a good opening bell, everyone, and I’ll see you on the beach!