The big economic data point for this morning was Retail Sales, and, for the 4th month in a row, American consumers have beaten forecasts, gobbling up stuff they don’t need with money they don’t have. (As a side note, I learned that about 50% of credit card balances are NOT paid each month, meaning these poor bastards are shelling out 20%+ interest to the likes of Jamie Dimon).

For whatever reason, equities didn’t taken kindly to this proof of ceaseless American gluttony, so an already weak market became weaker. We haven’t undone the damage from yesterday’s preposterous rally, but we’re getting there. Here’s the /ES futures:

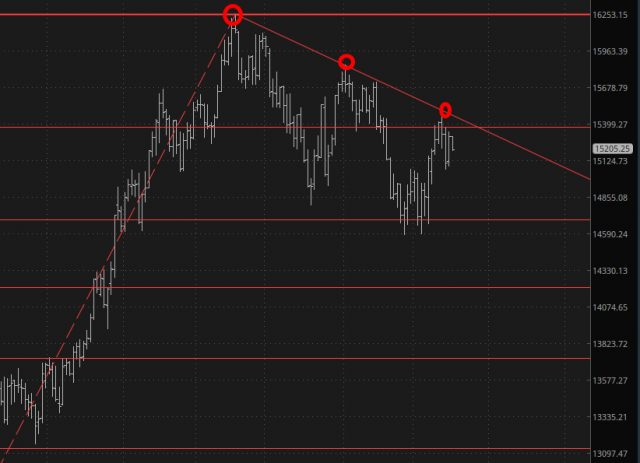

Likewise, here’s the /NQ, following the path I really prefer to see on any given day:

What’s astonishing to me is that, as always, every single “analyst” is demanding people buy stocks. Most of these people have never even see a bear market, and they stupidly figure that equities do nothing but go up – – except in the rare instances where they dip a month or two. I think they’re in for quite the surprise. The notion that the chart below (which is a longer-scale /NQ chart) is a “buy” is risible on its very face.

The bond market, bless it, has no such absurd notions about booming economic times and golly-gee-willikers prosperity. On the contrary, bonds are in their 4th year of a cataclysmic wipeout, and they are, yet again down another 1% this morning, goosing interest rates to levels that will be absolutely suffocating for the good (regular people like you and me), the bad (the government), and the ugly (our Treasury secretary).

For your beloved host, I am entering the day purely short with 7.5% cash ready to augment any favorite positions.