There’s no denying lots of action for both sides to make money this past week.

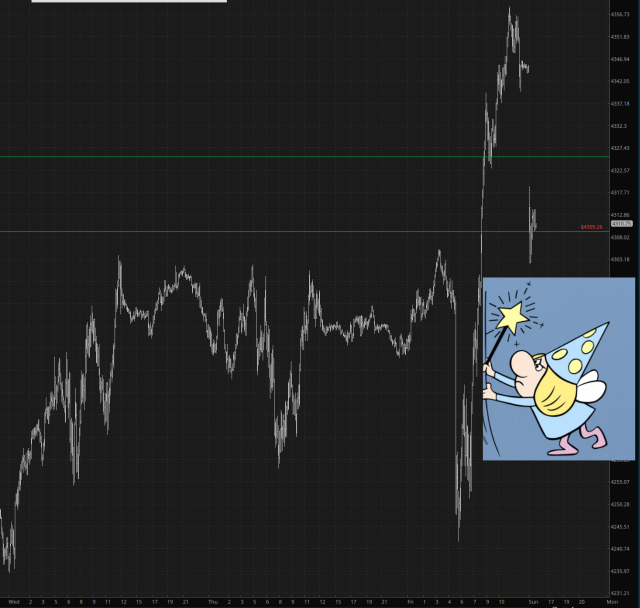

I decided to perform my entire analysis this week inverted. I always do this when things seem a bit stretched to try to rein in any bearish bias. The key areas I am watching are related to the breakout level of 4200, which was major resistance throughout 2022 into 2023, followed by breakdown level of 4360, which was prior support in late August. As for fundamental arguments on direction, I think sectors to watch will be how tech and banks start to react in the next week. While Friday left traders (i.e., me) shaken, I feel like this weekend I have had time to reassess and the bearish thesis still has legs. I will explain in further detail below.

(more…)