On Tuesday and Wednesday (both here and multiple times on tastylive) I pointed out how Tesla was coming to a day of reckoning. On the one hand, it was trying to conquer its trio of Fibonacci retracements, and on the other, it was slightly damaging its year-long ascending trendline. I pointed out that one thing that favored the bears was that we had been making lower highs, and the trendline already was fractured, which “opened us up to a trip to the next Fib support at 220.” I bought puts yesterday, which at the close were up 20%.

Well, these suckers are down almost another $20 at this point, thanks to a rather dour conference call. I’m amazed my “path to about $220” could be achieved so quickly!

Mercifully, I had no position at all in Netflix (NFLX) which shocked the world with its report and roaring higher.

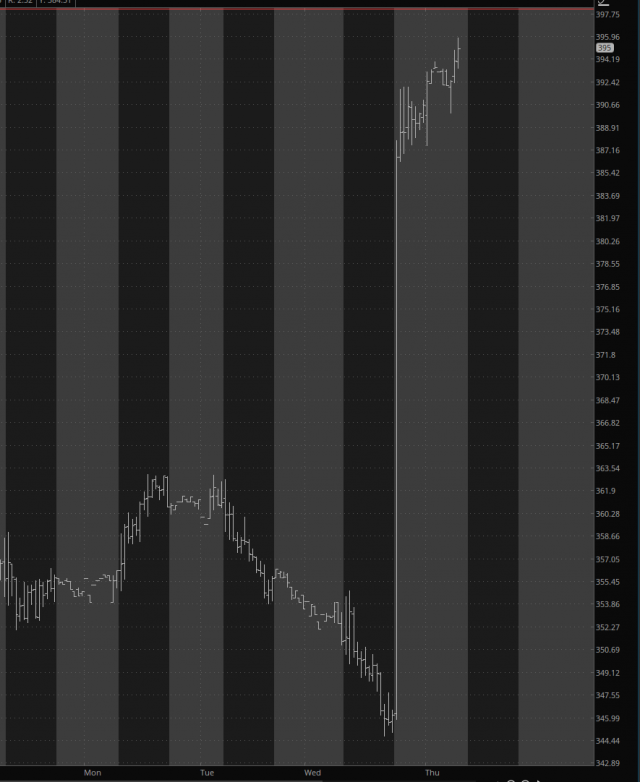

Ummm, wait a second, are you guys actually going to rally this thing up to that neckline?

To that, I can only offer this response.