It’s a new market day, and there are two ways I can tell: (1) the equity futures are all red (2) there is yet another breathless premium story from ZH about how the markets are ready to scream higher, thanks to someone at a huge investment bank who has, like, a totally objective and unbiased say in the matter. Honest to God, all these guys do is parrot whatever Goldman and Morgan tell them.

It’s a bit of an awkward feeling for me, since I actually have, gasp, ONE long position, which is slated to get smacked in the face at the opening bell, but I’ll likely hold tightly onto that unless some serious levels get violated. As for my other 15 positions, all bearish, of course, they should be just dandy.

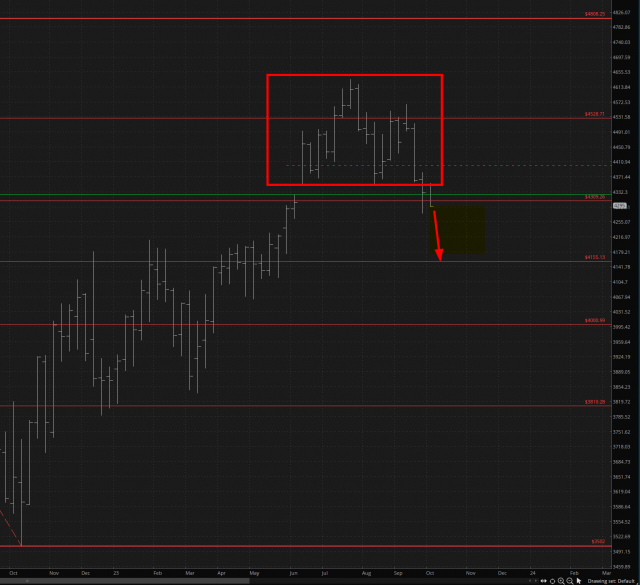

Take note how the /ES is probing the sub-Fibonacci level a little bit more every single time. This is starting to get serious, Zerohedge’s perma-bullish demands notwithstanding.

This is setting us up for what seemed IMPOSSIBLE just a few weeks ago, which is the prospect for a trip to 4186.

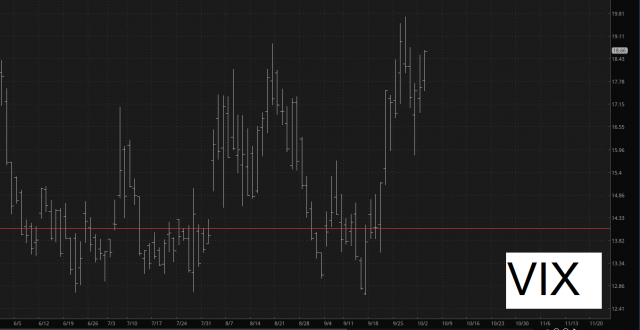

At the same time, volatility is starting to get frisky, having been at a laughable 12-handle merely days ago.

Bonds, likewise, are continuing to get ravaged. So, umm, those trillions and trillions of dollars that the government “invested” in their own bonds – – does the public realize the 10-figure bloodbath this “investment” is returning to their financial overlords? Because this is a train wreck. Indeed, any time I hear anyone from the government talk about how their spending is actually an investment, it turns my stomach. Using a different word doesn’t change the fact that the money is going directly down the toilet.

Anyway, I have felt remarkably in-synch with the market, and I will continue to strive for this, since it makes trading far more enjoyable to engage in and write about.