I saw this stock mentioned in my social media feed this morning. CK Hutschinson 0001 in Hong Kong.

This is a great stock and a great chart because it sits at the center of multiple macroeconomic trends.

Bull case for emerging markets can be boiled down to a few points.

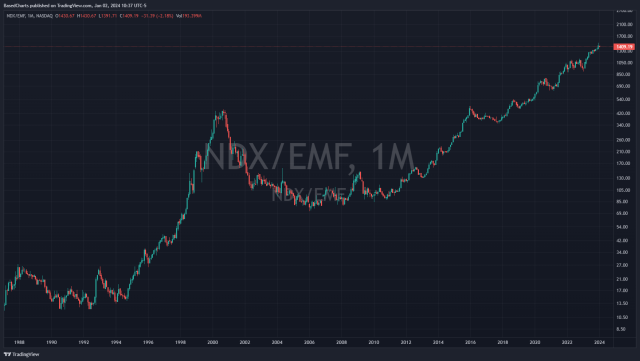

First, they’re as cheap as they were in the early 2000s if not cheaper. By sector analysis, where you compare tech to non-tech, they’re cheaper. I’m using the Templeton Emerging Markets Fund $EMF as a proxy here.

Two, China. If you’re a bull on China, emerging markets will benefit because…

Three, the U.S. dollar. If you’re bearish on the dollar, then emerging markets will benefit as it takes more dollars (and yuan) to obtain the natural resources and export products in those countries.

To my eye, only the first is an absolute reason to buy emerging markets. The other two are conditional, if/then factors. If you’re a long-only manager who must buy something, then relatively speaking, emerging markets are more attractive than the Nasdaq and S&P 500 7.

What makes CK attractive? It has a yield of around 7 percent. The forward price-to-earnings ratio is 6 and that ‘s based on the lower estimate. Dividends will go higher in a bull scenario, the p/e lower. Even if the economy remains sclerotic, it should yield around 4 to 5 percent outside of a bear collapse.

Support at the horizontal (2022 low) is about 13 percent away. A long position could be entered here or on a pullback. If the low is not taken out quickly, the dividends will limit downside to less than 10 percent.

If the low is taken out….here’s the bear scenario.

Both Hong Kong and China markets are sitting at critical support levels. Not major support lines, but levels below which the possibility of waterfall declines emerges.

A test of the 2008 low area opens up a drop of 40 to 50 percent on the Hong Kong market. CK would lose about 60 percent if it tested that area. A more likely support area in a bear move would be the HKD$25 region.

Assuming no disaster aside from market panic, assuming we can expect a return to something resembling current conditions (for the company) after a recession, that would put the expected p/e around 4 and the expected yield above 10 percent during the recovery timeframe.

My outlier bear scenario aside from a U.S.-led bear market and recession, is the Baizuo admin moves the U.S. closer to WW3 with China. I don’t know what probability it deserves, but the U.S. could eventually sanction China the way it sanctioned Russia, making it illegal for Americans/Westerners to own shares in stocks such as these. Perhaps this risk is partially priced in already.