Today has been shamefully devoid of original content by me. Before I head to bed, I wanted to fix that! Thus, below, I share a number of ETF charts and a few words about each of them, now that this first day of the trading year is behind us.

We begin with DBC, which is doing a yeoman’s job of sinking. It is approaching the lower half of its long-time descending channel, and I think energy is speaking truthfully to us about what’s ahead for the economy (as opposed to, let’s say, that four foot dwarf named Janet Yellen who ranks as one of the most vile and evil humans ever to be spawned on planet Earth, and whose very presence here is a curse to all decent men and women).

The IEFA, global equities, is sinking away from its long-term broken uptrend.

Gold miners still have an absolutely solid chance of rallying, provided prices don’t’ sink back again into that green tinted zone.

China, as always, is sucking panda bear, as it continues to weaken beneath its right triangle.

One of my three sine-wave trades, the small caps, had a nice down day today and is behaving itself perfectly properly.

Tech stocks got kicked in the balls, thanks to both severe AAPL weakness (investment bank downgrade) as well as profit-taking on tech in general.

The same holds true for semiconductors, which is of course very dependent on a single stock, Nvidia.

Bonds, precisely as I hoped and predicted, as sinking away from that broken red uptrend.

My second “sine wave trade”, utilities, was annoyingly strong today, perhaps as a defensive play. I actually bought a few more puts as it strengthened, but it sure as hell better start to weaken again soon.

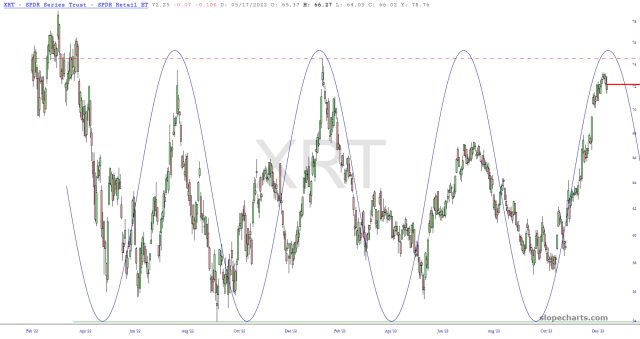

My third and final sine wave trade, retail, went down today, which is a good thing. I’ve got March puts on all of these (IWM, XRT, XLU) and am really needing these to work out before I get aggressive with my trading again.

It has been an exceptionally long day (trip to airport, miserable red-eye light, lots of driving, lots of packing, all the while trying to do my job more-or-less) so I’m going to turn in. See you on Wednesday!