I know I’ve been extremely silent for a while now. This is in some part due to my job keeping me busy, but the primary reason is my complete lack of comprehension of this market through December 31, 2023. I have had the occasional golden nugget and decent trade. But unfortunately, this past rally since the beginning of November killed me.

No two ways about it, I performed quite poorly and killed my account. So as Mickey Mouse said, if at first you don’t succeed, try, try again. I need to take what I learned and be better for it. With my embarrassing admission out of the way, I’ll note that I still don’t have a great handle on this market. All I know is that I can’t keep playing the indexes as they are too choppy with too many head-fakes with a relentless drift higher.

I’m still bearish on the market in general but it’s hard to raise a flag in victory if I am bearish during a 700 point rally. But the past two days have been nice. So I am going to do what I have found works better for me and act like a Bully and pick on the weakest stocks of the bunch. These should be immune to any market-wide rallies and at most run into clear resistance rather than breaking out. So here are the stocks I’m focusing on now.

This had peaked with the rest of the market in November 2021. It had a massive pullback from 300 to about 130 and then a fantastic bounce off that moving average all the way back up to 300 by May 2022. Fortunes were made and lost on this swing and I am a bit jealous I didn’t see it until now. Regardless, there has been a massive range formed since then and basically played ping-pong between 140 and 250 for about a year. What is intriguing to me is that this latest bounce within this range found significant resistance at 200. While the market indexes were flying high and pushing towards new highs, this was hitting that resistance and fighting to stay afloat.

That is the type of action I am looking for. If this can’t hold up with a potential bull market forming, then how bad will it drop if this bull market doesn’t come to fruition? With this failure and rejection from $200, I’m looking at least for a test of the prior major support at 120-130, which is also the 200 Week MA. That looks like an important spot so I’d expect at the very least a dead-cat bounce, so I’d look to cover anywhere there as a successful trade. I will however also keep my eye out for this to once again show a clear resistance zone in case this does want to continue to break down.

A failure of this massive range starts to look more like a major long-term top and could collapse possible to prior resistance around 90. On the shorter term chart (not shown), this already broke beneath a wide consolidation zone beneath 200, so if you are late to the party I’d play small or wait to see if this can head back up into resistance for a better price, but I think the next direction is down.

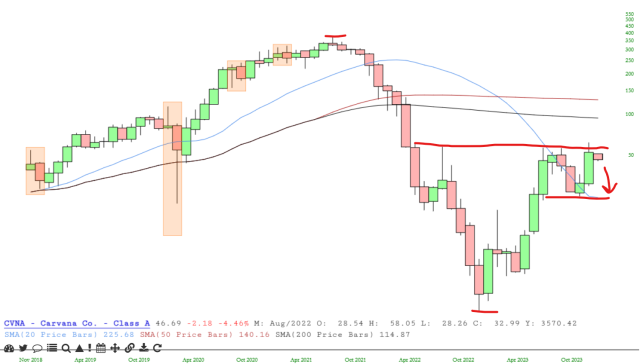

Fear since the top in 2021 from about $400 down to $4 (a 99% drop) by October 2022. Followed by a rally to $60 in 2023. This is a wild one. I can’t say for sure this is a major top and are headed back to single digits, but I am looking for a rejection here as this couldn’t hold onto the breakout attempt this past December. I’m aiming for a retest of $25 at the very least where there is a 20 Month MA. If this is to actually be a bottom, that would be a prime buy spot to reverse and start bouncing.

On the flipside, Energy seems to be basing and trying to turn up. This may be a good time to get long some energy stocks (XOM, CVX, ET are some that I am watching). That’s about it for me for now. Good luck to all this week and this new year.