On the heels of yesterday slightly-hot CPI report came this morning’s ice-cold PPI, which is actually indicating deflation (spoiler alert: that’s not as good a sign as the media wants you to believe). In any case, I’m glad I took the cue from the Fibonacci levels and GTFO of my IWM puts yesterday near the day’s low. Fool me once, etc………

Volatility is still making clear that the entirety of humanity believes Nothing Bad Will Ever Happen Again, Ever as we continue to grind near 12. Fine by me! I’ll just keep buying lovingly-chosen puts and waiting for Something to emerge.

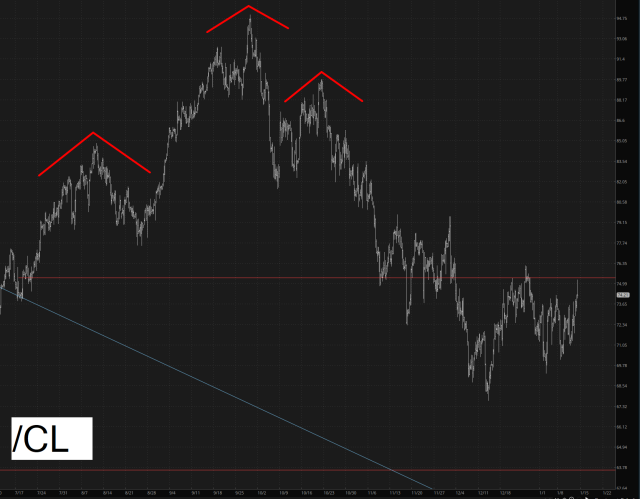

My attention is actually drawn to energy once more, as recent geopolitical mayhem has pushed prices higher and perhaps made energy shorts even more appealing. I’ll see what XOP and XLE look like today.

One last remark on the whole Bitcoin ETF thing: honest to God, my view is the entire crypto industry has never read a book about market history or psychology. It’s as if the weirdly-named Meltem asked Bitcoin to turn around and painted a huge red “X” on its back. Just take a look at what Bitcoin has done on the heels of the ridiculously overhyped ETF launch. People have INSTANTLY stopped caring!