At the outset, I should make plain my persistent skepticism about the utility of AI. Never in human history has there been so much aggressive chatter about artificial intelligence and its implications, and things started going berserk late in 2022 with ChatGPT and haven’t calmed down since then.

Countless times have I experimented with various AI tools, and with the exception of graphics generation (which is amazing), I walk away unimpressed.

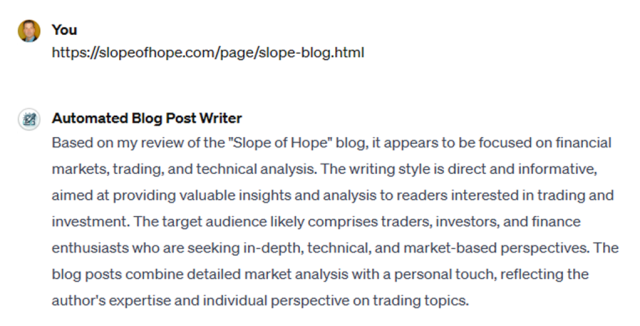

Earlier today, I decided to give AI another shot, since I saw something called Automated Blog Post Writer being featured as something superb. I thus gave it the URL to my own website’s blog section, and I was very impressed by how accurate its summation of my site was.

I then decided, with some apprehension, to see if this thing could kick me out of my own job, so I gave a good description as to a post I wanted it to write. I gave it a bit of guidance and set it off and running.

The result is below. I’ll refrain from my own opinion for the moment and just let you read this original piece. I’ve tidied it up with some formatting as a courtesy.

Based on the research from various sources, here's a detailed summary addressing the questions for the blog post about the potential closure of the Treasury Department's Bank Term Funding Program (BTFP) on its expiration date of March 11, 2024, and the financial and political implications of such a decision. What is the BTFP, and what has been its role since its inception? The BTFP was established by the Federal Reserve following the failures of Silicon Valley Bank and Signature Bank. It aimed to avert the destabilization of the banking system by allowing banks and other eligible depositories to access low-cost, one-year loans by pledging collateral at full par value. Potential financial implications of the BTFP's closure: The program has been popular, with borrowing from the facility reaching $124 billion as of December 13, 2023. Its removal could have significant consequences, particularly as banks continue to sit on large unrealized losses and rely on this "security blanket" for cheaper funding than other sources like the Federal Home Loan Banks or the private repurchase agreement market. If the Fed's rosier economic outlook for 2024 materializes, with stronger growth, lower unemployment, and slower price growth, the necessity of the BTFP might decrease, reducing the likelihood of its renewal. Impact on the banking sector and broader financial markets: The BTFP has been crucial in helping banks with unrealized losses on their balance sheets due to previous Fed's interest rate hikes. If the program ends without a similar facility in place, banks might face challenges in managing these losses, which could affect their liquidity and overall stability. Discussions in investment forums suggest a mix of surprise and concern among investors and analysts regarding the non-renewal of the program, indicating potential market volatility around the expiration date. Potential political ramifications: The decision to not renew the BTFP could be seen as a move towards normalizing monetary policy and reducing emergency economic measures, which might have broad political implications depending on the economic conditions at the time. Political reactions could vary based on the program's perceived success and the state of the economy, with potential debates over the necessity of such emergency measures and their impacts on financial stability. Historical precedents and similar scenarios: The BTFP has parallels with facilities deployed during the 2008 financial crisis, such as the Temporary Liquidity Guarantee Program. Its closure could be compared to the ending of these facilities, which were also designed to stabilize the banking sector during periods of financial distress.

Pfft. About as dry as toast, huh? And not a single dick joke or double entendre.

All I can think of is:

Undeterred, I decided to try a new product called Veed.IO which pledges to make original videos based on some descriptive information. So I gave it a shot.

It created the video for me in less than a minute. Here’s what it came up with. The writing is really elementary and seems to have been done by someone who isn’t fully comfortable with expressing themselves. In short, it’s 35 seconds that teaches you absolutely nothing.

If that isn’t enough for you, and you want to witness a REAL travesty, look no further than the company who has taken all the work of the late, great George Carlin (a man who should’ve been given a Pulitzer and a Nobel Prize, in my opinion) and tried to revive him with an hour of new material.

The voice KIND of sounds like him (if he spent a few years of his childhood in Alabama) and the jokes KIND of what he might say, but dear God, it’s an abomination.

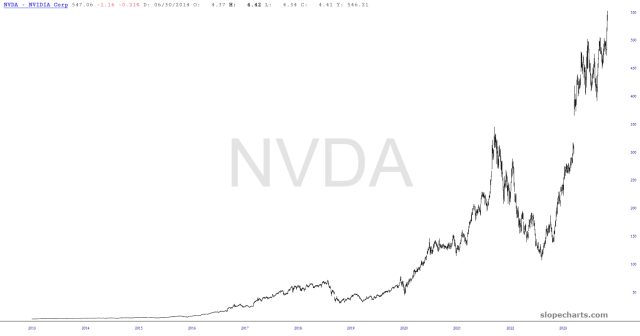

My conclusion? When the public finally wakes up from this delusion, all holy hell is going to break loose with the overvaluation of tech stocks, and the buzzword isn’t going to be “ChatGPT” anymore. It’s going to be “glut“.