From the Halloween bottom to now, the S&P has gone up over 800 points, and the Dow and S&P are approaching enormous Big Round Numbers (40,000 for the Dow and 5,000 for the S&P). It’s kind of like watching a person gain 5 pounds every day. After a while, it just gets kinda gross.

It’s particularly disturbing since this “should have happened” didn’t happen. Specifically, equities roaring higher made total sense when bonds were doing the same. Collapsing interest rates were key to the narrative. However, bonds topped out, as the chart anticipated, way back on December 27th. We all remember the Great Bear Market earlier this year (December 29 to January 5, a total of five trading days), but it’s been Nothing But Green ever since.

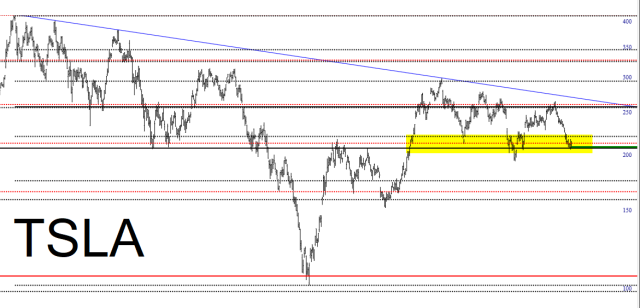

The big event today will be Tesla’s earnings after the close. Recent earnings events haven’t marked any kind of major inflection point in the stock. More important is the price’s relation to the trio of Fibonacci levels. The stock price should (and, in a way, MUST) hold these levels between now and Thursday.

Looking at the longer-term chart, you can see how vulnerable TSLA is if the Fibs fail.

As of now, I’m out of words. Let’s see what happens after the opening bell.