You know how markets work these days: up to record highs during normal hours, and down a minuscule tidbit in nighttime trading to make people think it still goes both directions. It happened again just now. On Sunday evening, equities were red across the board. As we approach the opening bell – – nope. Just another day in Federal-Reserve-Candy-Land.

The only potential sign of vulnerability seems to be the waning gusto of the NASDAQ. Shown here since October, the thrusts higher are clearly running out of steam, and if we don’t just make another pointless lifetime high today, one may begin to question just how much longer NVDA can prop up the entire global economy based on the hope that AI somehow solves all our problems by making everyone unemployed.

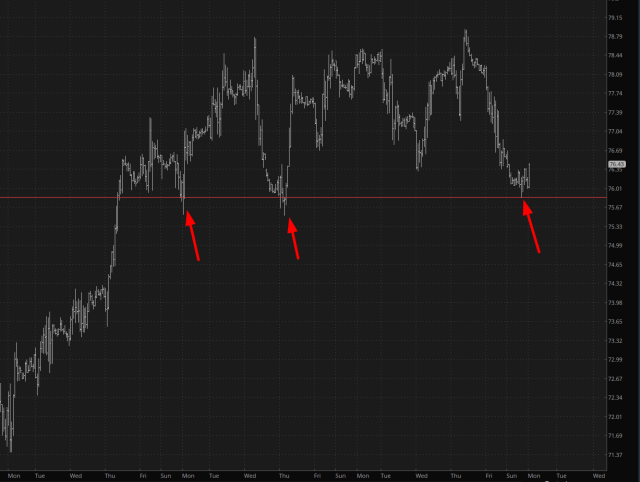

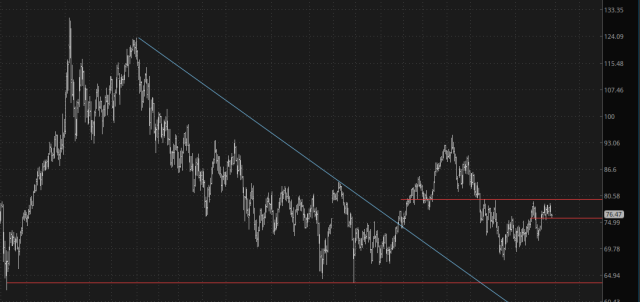

Crude oil seems to have found some medium-term stability.

This is an important lever since, as viewed with the longer-term crude oil chart, we have been range-bound for many weeks, and the break from this range should be fairly hearty in whatever direction the breakout occurs.

I see quite a few comments in my prior post, so I’ll be sure to read those soon. Thank you for any helpful remarks that were left there.